Well, many people might actually be missing out on a lot of those because they don’t know about them. People who earn more than $200,000 have a 3.7% chance of being audited by the IRS. The odds are even higher for those who earn more than a million dollars (12.5%). But people making that kind of money don’t exactly need to be told to hire a personal accountant. The blog articles on this website are provided for general educational and informational purposes only, and no content included is intended to be used as financial or legal advice.

- This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

- Your comfort level with managing financial tasks is also a key consideration.

- Getting married, having a child, buying a house, or retiring can all impact your tax strategy.

- It’s essential to weigh these against the benefits before making a decision.

- They operate on an in-depth understanding of their client’s financial situations, goals, and concerns, enabling them to provide personalized advice and strategic financial solutions.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Analyzing Financial Management Skills

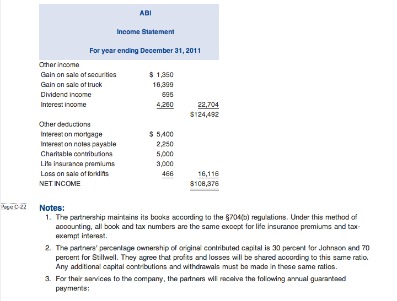

Alternatives include accounting software, bookkeeping, or self-education in financial management. In the case of small businesses, accountants streamline processes, ensure tax compliance, offer strategic advice, and save time. If you’re just starting out as a small business owner, an accountant could help with the financial segments of your business plan. During day-to-day operations, a good accountant can help with everything from opening a business bank account to payroll to providing guidance regarding government regulations or any changes in tax law. The term “accountant” is sometimes used as a catch-all phrase to refer to any professional who deals with financial transactions or taxes, but there are different types of accountants.

Do you already work with a financial advisor?

The last thing a person in debt needs is to owe more money to someone. Therefore, an accountant who will help with budgeting, cost-cutting, and filing taxes to make sure there are no state or federal debts will be a godsend. In other words, when a person finds themselves not understanding their tax obligations or struggling to keep personal accountant an eye on every detail regarding their personal finances, they should hire a personal accountant. A personal accountant will be most helpful in a specific situation. Understand the personal accountant’s pricing structure, including any hourly rates, fixed fees, or retainer arrangements.

How confident are you in your long term financial plan?

- In short, an accountant can assist with most things money-related so that the business owner can focus on the business.

- They can optimize tax deductions, provide estate planning advice, and ensure regulatory compliance, freeing individuals from the complexities of personal financial management.

- The method of remuneration for a personal accountant can be different from a financial advisor.

- Financial planning is a broad term that includes several aspects.

- Although it can be costly and even make a big dent in someone’s budget, if a person has found themselves in one of these ten situations, the cost of a personal accountant will be worth it.

- This level of efficiency can help improve cash flow, reduce unnecessary expenses, and improve the financial health of a business or individual.

Managing personal finances can be time-consuming and stressful, especially for those unfamiliar with financial management. A personal accountant takes over this burden, enabling you to focus on other aspects of life while enjoying peace of mind knowing your finances are in good hands. While an accountant can help with handling bills, filing tax returns, bookkeeping and so on, a financial advisor will strictly help you plan for your money. A personal accountant will keep a record of your transactions, particularly those relating to personal finances.

Why You Can Trust Finance Strategists

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

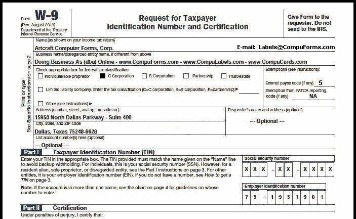

- People who successfully pass the CPA exam and meet all other state requirements can apply for licensure.

- Licensed professionals must complete CPE credits and pay a renewal fee to their state’s board of accountancy.

- Whether it’s planning for retirement or estate planning, a personal accountant assists in mapping out long-term financial strategies.

- Such programs make it easier for you to record and track your own transactions.

- Here’s how to determine if you need a personal accountant, and if so, how to find the best one for your specific situation.

This website focuses on accounting jobs and offers filters based on location and job function. Candidates upload their resumes, which employers can use to solicit applications for open positions. People inching toward retirement and thinking https://www.bookstime.com/ about finally cashing in on those 401Ks and all other hard-earned investments need to think about how they will handle this change logistically. Some people need an accountant to help them set up a college fund for their kids. Others, on the other hand, need help to fill and file paperwork for FAFSA and get help funding their kid’s education. Having a couple of properties, renting them, and seeing money pour in every month is great – until tax season.

Is the CPA exam hard?

An accountant is also more likely to be on top of the latest changes in the tax law. Understanding the role, benefits, challenges, and qualifications of a personal accountant empowers individuals to make informed decisions about managing their finances. Many people tend to avoid the idea of having a personal accountant or financial advisor. I understand that because most of service providers charge much money that it is not even worth it to benefit from their service. Accountants who wish to increase their earning potential and strengthen their career prospects may benefit from CPA designation. According to Payscale, as of April 2024, noncertified accountants make an average salary of $57,430, while CPAs earn $76,960 annually — nearly $20,000 higher than noncertified accountants.

You can hire them as an individual if you want help in managing your taxes, reducing income tax or estate tax, etc. This keeps many individuals away from investing and saving their money. This distance from financial acumen and proper understanding of different financial strategies and investment instruments also create negligence about the kind of help you can get to simplify your finances. A personal accountant and a financial advisor are often used interchangeably.

They can also identify tax-saving opportunities and strategies, ensuring you pay no more tax than necessary. Becoming a retained earnings licensed CPA requires passing the Uniform CPA Exam and completing continuing education hours each year in order to maintain their certification. CPA fees can range anywhere from approximately $33 to $500 an hour. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify. Their expertise not only enhances financial stability but also contributes to long-term financial success.