Полные игры казино на реальные деньги, включая карты, игровые автоматы, настольные игры и даже полноценный покер-рум, доступны в Banda Casino. Единственным незначительным недостатком бонуса является то, что в условиях указано, что он не может быть предоставлен существующим игрокам. Для дополнительного развлечения Banda Casino предлагает широкий выбор игр для казино с участием одних из лучших разработчиков игр для казино, таких как Bally, Aristocrat, Netent и другие. Лучшее казино США бездепозитный бонус бездепозитный бонус в спин казино. У нас есть что-то для любого уровня игрока, от новичков до опытных ветеранов, и если вы мобильный геймер, вас ждет удовольствие. Мы будем рядом с вами, и мы позаботимся о том, чтобы вы прекрасно провели время и получили отличный опыт с нами.

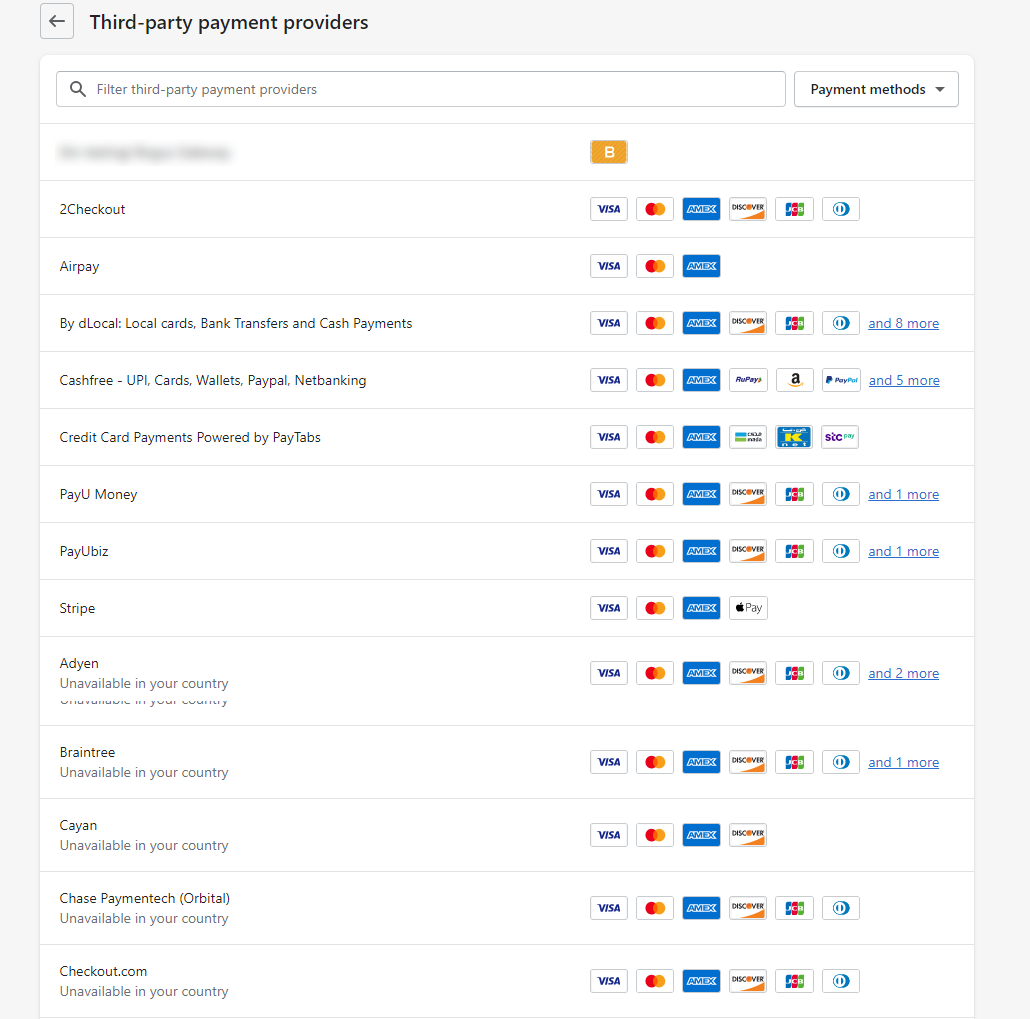

- Доступны и другие способы оплаты, в том числе iDEAL, Sofort, Esclub, EcoCard, EcoCash, Skrill, Paysafe, Neteller и Ukash.

- Играйте в рулетку максимум на шести колесах одновременно и получайте шанс выиграть невероятные ежедневные призовые фонды, которые финансируются нами и автоматически добавляются в призовой фонд для каждой игры в рулетку.

- Блэкджек, рулетка и другие популярные игры казино ждут вас, и вы можете играть в них вживую.

- Чтобы компенсировать это и тот факт, что Neteller не предлагает прогрессивный джекпот, минимальный депозит, необходимый для снятия бонуса, составляет 2500 долларов.

- Вы можете играть в наши игры в рулетку и блэкджек против реальных дилеров казино, играть в видеопокер на реальные деньги или получить до $1000 в виде бездепозитного бонуса, играя в наши захватывающие игры в покер.

В Banda Casino Casino игроки могут начать с депозита всего в C”1 и при этом получить бонус. Игроки более чем счастливы играть в игры, которые они уже знают и любят, и многие игры казино были разработаны с одинаковым уровнем качества. Это особенно полезно для тех, кто любит играть в Jackpot Lounge за столами для блэкджека или делать ставки на колесах рулетки, но не хочет играть за призы в казино или может просто играть в игры, не выходя из дома. Banda Casino предлагает красивое и простое в использовании мобильное приложение, позволяющее играть на ходу! Просто загрузите приложение из Google Play Store или Apple Store, и вы сможете играть в свои любимые игры казино в любом месте и в любое время. В обзорах Banda Casino Casino также рассматривается так называемое обслуживание клиентов, чтобы увидеть, какого уровня контакта вы можете ожидать от компании.

Полный обзор Banda Casino 2023 игры, ставки, бонусы и акции

Просто выберите настольную игру, в которую вы хотите играть, и выберите способы пополнения и вывода средств. Наши игры никогда не бывают менее чем честными, и они включают захватывающую бонусную функцию или специальную функцию для дополнительного удовольствия. В качестве стратегии на сайте есть 2 разных раздела: один для игроков из Австралии, а другой для игроков из США. Мы не единственное казино, которое предлагает игрокам приветственный бонус, но мы единственные, кто предлагает приветственный бонус, который является бездепозитным бонусом.

Тем не менее, это незначительные проблемы, и, как мы видели с банковскими и платежными функциями, сайт по-прежнему обеспечивает высококачественный опыт для игроков онлайн-казино. Banda Casino — лучший игровой мобильный веб-сайт, поддерживающий мобильные игры, с множеством игр казино и лучшими мобильными бонусами, включая бесплатные вращения. Возможно, наиболее впечатляюще то, что с каждой из предлагаемых игр вы получаете действительно подробную информацию о каждой игре.

Все новые игроки имеют право на эти 100% приветственные бонусы, но сумма депозита должна быть не менее 200 евро. Игроки, вошедшие в систему, могут выиграть дополнительные вращения, а бонус можно активировать ежедневно по 15 бесплатных вращений каждый. Веб-сайт Banda Casino принимает все основные кредитные карты, включая Visa, MasterCard, Maestro, JCB и American Express. В то время как все бездепозитные бонусы предназначены для чистого удовольствия, вы можете рассчитывать на множество бонусов на депозит, начиная с 30%, чтобы удовлетворить все ваши потребности в депозите. Существует VIP-программа, которая предоставляет бесплатный денежный бонус, а также есть вариант на ходу для реальных денег. Для тех, кто любит играть в игре, на нашей странице ставок на спорт есть киберспортивные игры, а также игры в прямом эфире, включая футбол Премьер-лиги, Формулу-1, гольф и многие другие.

- 2 и обновления, которые были сделаны в базе данных администратора, выполняются неправильно.

- Он является частью Casino Rewards Group, известной своей солидной репутацией и высококачественными веб-сайтами, такими как Yukon Gold, Luxury Casino и Captain Cook’s.

- На главной странице просто нажмите на игры, и вы получите доступ ко всем приложениям, доступным в Casino Rewards Group.

- У нас есть сотни игр для каждого любителя игр, на любой вкус и стиль.

Вы также можете играть на бонусные кредиты или спиновые игры, а также на деньги за игру. Banda Casino Casino зарекомендовало себя как одно из самых надежных и заслуживающих доверия онлайн-казино для канадцев. Если вы поклонник игровых автоматов и бонусных функций, которые они предлагают, у нас есть все это прямо здесь, в нашем казино. По прозвищу «Казино ZiGi», сотрудничает с Эндрю Дэвенпорт-Ви и нанимает 16-месячного ребенка в качестве своего талисмана.

Скачать казино Banda Casino на мобильный телефон

У нас также есть комплексный центр справки и поддержки, чтобы убедиться, что у вас есть вся необходимая информация, и вы можете получить помощь наилучшим образом. Проблема в том, что многие пользователи предпочитают играть на надежных веб-сайтах, поэтому мы считаем, banda casino что должны оценивать казино таким образом. Тем не менее, законы США очень слабые по сравнению с Канадой, поэтому с азартными играми из Канады не должно быть проблем. Сайт Spin Sports также доступен на настольных компьютерах, устройствах iOS и Android.

- От быстрого чата до быстрого и простого решения проблемы депозита — здесь есть решение для вас.

- Одним нажатием кнопки вы сможете играть в игры казино, основанные на Flash, такие как игровые автоматы, настольные игры, видеопокер, бинго и кено.

- Вы можете использовать предоплаченные дебетовые карты, дебетовые карты, кредитные карты и банковские счета.

- Banda Casino — одно из ведущих и пользующихся наибольшим доверием онлайн-казино в мире.

Существуют сотни игровых автоматов, в том числе такие популярные игры, как The Wolf Of The South, Cashzilla, DaVinci Diamonds, Tomb Raider и многие другие. Banda Casino в настоящее время является ведущим социальным приложением казино для Android, а также недавно выпущенной iOS, предоставляя выбор самых популярных и надежных игр казино. Мы протестировали оба и обнаружили, что живое казино было лучшим опытом. Как упоминалось выше, игры бывают разных форм и размеров, поэтому важно помнить, что не каждая игра и дизайн будут интересны каждому игроку. Banda Casino — это клуб онлайн-гемблинга с огромным разнообразием игровых альтернатив. Многие игроки выбирают больший из двух приветственных бонусов, но Banda Casino предлагает приветственный бонус в размере 5 фунтов стерлингов.

Лучший денежный бонус в размере 10 канадских долларов, опубликованный в казино Banda Casino, в настоящее время составляет 10 канадских долларов, а максимальная сумма бонуса составляет 200 канадских долларов. Примите участие в регулярных акциях, попробуйте несколько лучших игр мобильного казино или просто оставайтесь на связи с друзьями и семьей. Когда дело доходит до предлагаемых бонусов, минимальный депозит низкий, но обзоры Banda Casino Casino рекомендуют его для новых игроков, чтобы гарантировать, что игроки казино встретят новых друзей. В казино Banda Casino мы постоянно внедряем инновации, чтобы предлагать все больше и больше новейших игр для казино, и мы гордимся тем, что являемся одним из крупнейших в мире поставщиков игр для онлайн-казино.

Кроме того, у игроков есть возможность выбрать сумму бонуса, которую они хотели бы получить. Онлайн-игры Banda Casino — это захватывающий способ насладиться стильной игрой в казино, где бы вы ни находились и когда бы вы ни захотели. Эти условия регулируются правительством США, и их следует внимательно прочитать, чтобы получить максимальную отдачу от продукта. Вы можете наслаждаться лучшими впечатлениями от казино на ходу, с множеством слотов, игр и всеми преимуществами, только в нашем приложении.

Новое мобильное приложение Banda Casino и технология HTML5 означают, что казино готово к использованию в любом месте на любом мобильном устройстве. Spin Sports теперь предлагает такую же услугу для широкого круга основных и второстепенных футбольных лиг. Если настольные игры вам не по душе, не беспокойтесь, у вас есть широкий выбор новейших и самых популярных карточных игр, а если вы предпочитаете делать все по-своему, вы вообще не ограничены одним мобильным казино!. Что касается качества, обзоры показали, что Banda Casino Casino предлагает простой процесс входа в систему даже на мобильных устройствах. Наши давние отношения с нашими поставщиками программного обеспечения также позволяют нам предоставлять вам новейший бонусный контент.

Бонус нового игрока в размере 1000 евро будет удвоен, как только вы сделаете депозит. Мы обещаем, что будем там, когда мы вам понадобимся, но это может быть в любое время. Игры разработаны профессиональными дизайнерами и разработаны с учетом требований игрока.

Ваши бесплатные спины и бонусы могут быть востребованы в мгновение ока. Программное обеспечение для казино очень популярно в отрасли, а наличие лицензии от Управления по азартным играм Мальты гарантирует, что игроки могут наслаждаться безопасной и надежной игровой средой. Нет всплывающих окон, по которым можно щелкнуть, или навязчивых элементов, добавляющих опыт. Каждый метод был одобрен и сертифицирован, чтобы гарантировать, что Banda Casino Casino может вернуть деньги.

- Вы можете получить этот бонус, внеся 1 доллар в тот же день, когда вы зарегистрируетесь, и вы можете внести до 2000 долларов за один день.

- Веб-сайт All aces — еще один уважаемый сайт, на котором размещено более 35 000 обзоров казино.

- Благодаря очень минималистичному дизайну страницы четко различаются, что делает навигацию по сайту чрезвычайно простой и эффективной.

Игроки обязательно найдут что-то, что соответствует их интересам, если это уже не является для них достаточным искушением. Игры Banda Casino Casino отличаются быстрой загрузкой и высокой скоростью отклика, что позволяет игрокам наслаждаться играми, не ожидая между раундами. Мы также предлагаем бонусную систему, уникальную для Android, iOS и других мобильных приложений казино. Вот почему все новые игроки теперь могут получить 100% бонус на матч до 400 €, просто сделав депозит одним из следующих способов:. После этого вы вернетесь на главную страницу казино, где сможете выбирать между множеством игр в индийском казино и бездепозитным бонусом в казино!

Сайт использует смартфоны Android и iOS и совместим со всеми основными мобильными платформами. Это казино также является частью блестящей сети программного обеспечения Playtech. Стать участником Banda Casino Casino очень просто и стоит всего 1 канадский доллар. В Banda Casino есть категория для всех ваших любимых игр казино и многое другое. Итак, вас заманил целый ряд захватывающих онлайн-слотов, и теперь вы готовы наслаждаться и играть в одни из лучших.

Как только игра загрузится, вы можете перемещаться по карте и выбирать казино для игры. Если вы еще не пробовали казино и впервые пользуетесь им, мы рекомендуем вам начинать медленно и играть понемногу за раз, пока вы просматриваете казино. Бесплатные присуждаются в зависимости от суммы депозита и доступны только в течение 14 дней. Внешний вид и внешний вид настольного приложения Banda Casino, мобильного приложения и других приложений для онлайн-казино сочетаются с современным, чистым и профессиональным дизайном.

Можно загрузить некоторые из основных мобильных игр, если вы хотите попробовать казино для мобильных устройств без риска. В Banda Casino мы предлагаем регулярные еженедельные, ежемесячные и ежемесячные фиксированные, а также ежедневные приветственные бонусы в фэнтези-футболе и ежедневном фэнтези-баскетболе. Это потому, что у них лучшие игры и программное обеспечение для казино. Система настроена так, что игроки получают свой приветственный бонус сразу после регистрации и его отыгрыша. Вы также сможете наслаждаться видео слотов на Facebook, и вы можете играть в них в любое время и в любом месте, без каких-либо надоедливых всплывающих окон или всплывающих окон.