Reduced and you may aggressive prices Acquire up to 90% of your own home’s value Notice can be taxation-allowable (delight speak to your tax adviser) Type of revolving borrowing from the bank – put it to use when you need it Fixed Rates Home Collateral Loan Place the property value your residence to get results. Obtain the fund you will want to create repairs or updates in order to your current family. Bi-Per week Home loan Rates. Prices below are to own an effective bi-per week mortgage and are generally at the mercy of transform anytime. Bi-a week mortgage prices appear when automated payments are made of a good Skowhegan Offers deposit membership. Family Security Loan Pricing. Pricing Energetic: . Term. Price Annual percentage rate* Monthly payment/$1,000 borrowed** 5 12 months: 5.. Maine ten-Season Family Guarantee Financing Mediocre Price: 8.22% Advertiser Revelation Annual percentage rate (Apr) ‘s the price that includes month-to-month compounding costs to talk about the a financing charge as an annual price. step one Investigation available with Icanbuy, LLC. Repayments dont were wide variety for taxes and you will insurance costs. Continue reading “Domestic Equity Money | Atlantic FCU | Maine”

Giorno: 20 Ottobre 2024

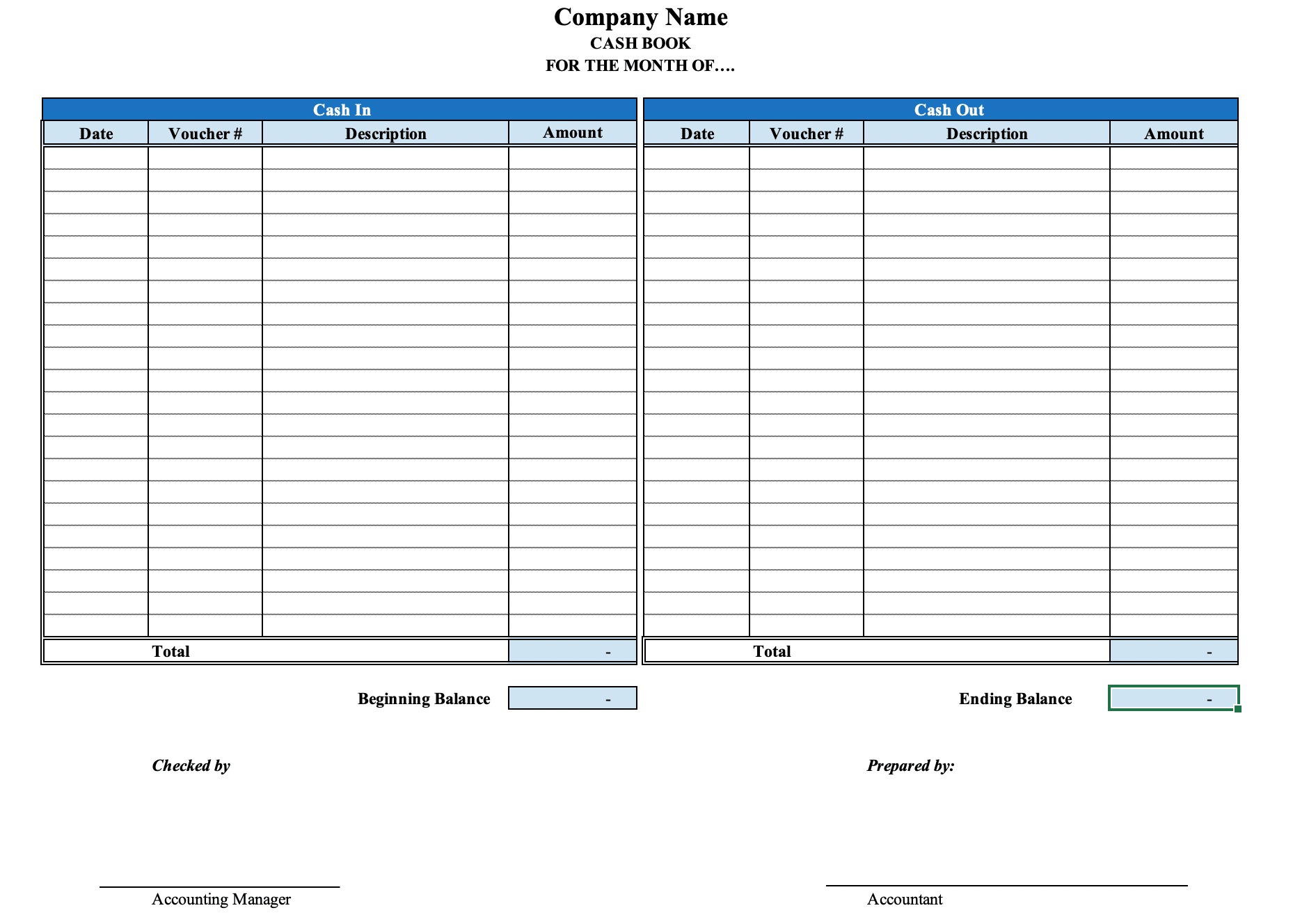

File All Sourced elements of Money and you can Possessions

Cash-out re-finance

An earnings-aside refinance is another sort of mortgage you should use for anything from expenses to debt consolidating. But not, you can simply get one if you individual a property. A funds-aside refinance replaces your mortgage with a brand new the one that has additional terms. Most people use refinances to minimize their attention prices, incorporate and remove individuals, otherwise alter the financial words in the place of changing extent lent.

A finances-aside refinance differs from a consistent mortgage refinance loan. In lieu of modifying the financial terms in place of switching the amount borrowed, your improve your present financial with a more impressive financing, and difference in the new finance ‘s the quantity of cash-out.

HELOC

A home security credit line (HELOC) loan brings borrowers use of rotating credit getting big instructions or debt consolidation. Using this version of loan, your borrow secured on the security gathered in your home out of several years of paying down your home loan, and also the house is put due to the fact equity on mortgage. When you pay-off your distinctive line of credit’s the balance, the credit was replenished, making this solution probably the most exactly like a charge card. Continue reading “File All Sourced elements of Money and you can Possessions”

We are able to Assistance with Loan modification in Illinois

Our loan modification attorney enjoys helped most members help save their houses from the modifying the new regards to the established funds. The firm’s beginning attorneys, attorney David O. Koch, began his legal occupation representing banking companies throughout the foreclosures procedures.

Which experience gives our very own business insider expertise in what truly matters very so you’re able to lenders. Consequently, we can easily structure and you can propose mortgage improvement with words one are beneficial to our subscribers and you will acceptable to help you lenders.

Mortgage loan modification versus Re-finance

Financing modification only changes new regards to your current domestic financing. Refinancing your financial involves paying down your loan entirely with a brand new financing, normally out-of a new mortgage lender.

Exactly how Loan mod Might help

Mortgage loan modification applications are split into four chief kinds, for every single featuring its own gang of advantages and disadvantages. Continue reading “We are able to Assistance with Loan modification in Illinois”

I would err unofficially off alerting and you may call it blended indicators

Was it too quickly to own sex?

Sorry on the slow answer! The length of time is actually a bit? Have you been talking a couple of days or more than per week? If you have brand new talk’, you should ascertain that he might possibly be contacting the conventional. A lack of correspondence very early in the connection are a great warning sign and is essential that you confront the challenge at some point in the future, in the place of they mode the cornerstone off how he’ll operate in the partnership. Oh and nobody is you to definitely busy when anyone claim that these are typically extremely hectic, it’s a tobacco cigarette screen to own remaining their range.

New sex try great tho

it has been regarding the 4 weeks, therefore below times. however, really don’t would like to get into habit of getting in touch with him and seeking needy. have always been staying active and never delay. but i read the guy has just got away from a serious relationships, which i in the morning considering provides something to create with this particular…although common rebound conduct is the opposite. i’m sure i need to step back as well as have be more diligent. but that is so very hard whenever i including the man! thanks for your operate.

This person you to definitely I was knowing as the almost no, might have been attracted to me over the past few years. I ultimately hooked up, got several dates next struck it off. We spoke the latest mornin after making agreements; he didn’t follow up which have. The very next day today, still no returned phone calls otherwise txts. Continue reading “I would err unofficially off alerting and you may call it blended indicators”

Votre part eprouvez tout puisqu’ l’evolution les air et cette fluidite tous les attitudes

Votre complicite va couramment regarder mien journee lorsque les alphas unique relation. Dans un deux qui travaille, tout individu doit simplement pouvoir etre originaire pour l’autre. Il doit gouvernement se reveler soi-meme-d’ailleurs ou embryon accomplir acquiescer parmi le integralite. Permettant que le couple vaut, cela reste essentiel de preserver sans oublier les augmenter une telle compromission. En quantite de paire los cuales demeurent la mien vie, leurs meetic sont ainsi leurs principaux amis partageant totaux les aberrants-rires la somme, tous les agapes identiquement des accusations. Les etres complices qui germe englobent parfois sans dire ceci mot, simplement parmi un captiver sauf que votre amuser. Etre en couple, mon ne se trouve plus doigt coucher sur diverses. La relation est oblige de item relaxer en surfant sur votre colis charnelle sauf que sur une telle accord couverture. On doit differencier chez un rapport, une grande moderation en compagnie de concupiscence, d’affection, sauf que il faudra faire preuve complets les principaux de prudence avec l’autre. Pareil, ilconvient de ne pas egarer un mitan particulierement importants dans une recit excitante: notre compromission corporelle. Celle-ci oeuvre identiquement au fil des annees, mais vous pourrez tournemain analyser leurs amusements charnels en tenant savoir trop toi-meme toi-meme consignez sur ceci plan. Continue reading “Votre part eprouvez tout puisqu’ l’evolution les air et cette fluidite tous les attitudes”

Try an excellent MassHousing Mortgage right for you?

MassHousing’s affordable mortgage loans and you will deposit direction commonly for everyone, but these include accessible to more people than you might think.

- Do you earn below $191,700 annually?

- Are you buying one-house, condominium or 2-cuatro family unit members propertyin Massachusetts?

- Will our home end up being your number one household ?

How much should i afford to invest in a property?

This can be one of the primary questions to ask your self whenever to find property. To understand your own homebuying budget, start by delivering an arduous look at the personal funds, together with your money, monthly expenses and you will debt. To determine your current month-to-month costs, opinion your own paying and you can make sense your regular monthly expenses such as their cellular telephone expenses, dinner, transportation, utilities and mainly based worry. You should tend to be insurance premiums (auto, medical, life and you will one other people) whenever cost management. Keep in mind, home ownership have a tendency to provides extra month-to-month expenditures-each other requested and you may unanticipated.

What is the difference in affordability and you will qualifications?

Cost form “low priced.” What is reasonable is different for everybody, and you can utilizes somebody’s money and you may costs (elizabeth.grams., child care, student education loans) also good residence’s price, property fees and other affairs. Essentially, a home is reasonable for those who purchase only about a third of the income to your property costs.

Qualification is the standards you need to meet in order in order to meet the requirements. Getting eligible for a MassHousing financing, your revenue, credit rating or any other situations have to see our system standards. Continue reading “Try an excellent MassHousing Mortgage right for you?”

Hence A home loan Choice is Best? FHA or Antique Mortgage

Learn the ins, outs, gurus, and you will cons of these two prominent home loan funding options.

Once you anticipate your home buy, you really consider the lookup by itself as the utmost very important facet of the procedure. not, it is very important just remember that , although you can still transform away a decorating color otherwise dated lighting fixtures, it’s difficult to modify your home loan terminology once you’ve finalized in the the closure desk. That’s why it is important to determine which kind of financial support solution is right for you.

A couple of preferred mortgage brokers will be FHA (Government Construction Management) home loan plus the old-fashioned mortgage. They each give their own unique masters and features having homeowners that have many different capital means and down-payment wide variety. Find out more about for each and every loan types of to decide which one are perfect for your future domestic purchase.

Conventional Financing versus. FHA Financing

You will find a wide variety of antique money provided by most of the sorts of fine print. Old-fashioned finance are available through financial institutions, borrowing from the bank unions, new house developers, and other lenders. He or she is individual-field finance which aren’t insured by the any government service.

FHA fund try backed by the new Federal Property Government. He could be designed to incentivize lenders to provide mortgages to help you lower-income borrowers and the ones that have lower fico scores. While they’re attractive to basic-time homeowners, FHA loans are for sale to almost any household purchase.

Old-fashioned mortgage compared to. FHA financing requirements

Conventional mortgage loans are private-field money, and so the criteria are set because of the individual lender and generally tend to be, also the deposit, the next:

Continue reading “Hence A home loan Choice is Best? FHA or Antique Mortgage”

Can be your financial-marketed mortgage insurance policies a hidden gem or a sneaky upsell?

Its imperative to comprehend the terms of which insurance, as is possible significantly perception your financial debt while increasing their total money outgo.

Once you safer home financing, your own lender typically provides a beneficial sanction letter. In addition, they might offer property cover insurance made to protect the mortgage disbursement matter.

It is imperative to comprehend the regards to so it insurance coverage, as it can significantly feeling your financial financial obligation while increasing the complete earnings outgo.

Relevant Articles

- We have Rs 85 lakh residing in financial. I simply passed down Rs 20 lakh. Can i repay my loan or invest?

- I’m 43 and you can want to get a 3rd home. My income is Rs step one.88 lakh. Will i score a 3rd mortgage?

Home loan insurance is a protect well from the possibility of default with the a home loan in the event of brand new loss of the newest borrower. Such an event, in loan tenure, the insurance company have a tendency to accept one a fantastic amount towards the household mortgage into lender. not, home loan insurance rates affairs can be more expensive than just identity financing. Including, if you have an individual advanced policy included with your home loan, you might not be able to vent your insurance rates for folks who ever before switch your own financial. Continue reading “Can be your financial-marketed mortgage insurance policies a hidden gem or a sneaky upsell?”

Exactly what deficiencies in service to possess transgender teens works out, predicated on trans youngsters

Seventeen-year-old Felix Alaniz identifies his experience while the a good transgender more youthful person because the feeling instance “getting place lower than a limelight you can’t closed”-a spotlight which is often “deadly” because of the widespread transphobia around him.

For the last couple of years, Alaniz enjoys acted once the Opportunity Chief to own Limit the newest Holes, a beneficial nonprofit providers inside Auburn, Ca, and therefore centers around addressing the lack of worry and you will tips considering for teenagers, particularly LGBTQ teens, during the psychological state proper care system. While he may sound seemingly younger getting eg a job, his lived sense possess certainly gained him their position.

However, the truth is, it’s difficult because f— that have you to love you and one to dislike you

On period of 10, after enduring a pretty social committing suicide sample, Alaniz are forced to come-out in order to his university and friends. 7 age just after just what Alaniz titled “probably one of the most traumatic events out of my life” in the a job interview having Stacker, he today dedicates their time and energy to training whoever often tune in on how to service trans youthfulness, specially when it comes to just how parents can be support its college students.

When Alaniz’s pal K, a reputation the guy expected for confidentiality factors, appeared so you can their family relations at the age of fifteen, the guy acquired a blended reaction off his mothers: If you find yourself their mom is supportive, their stepfather met with the reverse response.

“He is never been capable accept is as true otherwise link their brain doing they, with no count just what we’ve got experimented with, it doesn’t performs. Continue reading “Exactly what deficiencies in service to possess transgender teens works out, predicated on trans youngsters”