Choosing the right lender renders a big difference for the dealing with your finances. Commonly, it initiate by going for which type of organization, such as a cards commitment otherwise bank. Immediately, it age. Yet not, there are key differences between the two that you need to end up being conscious of. However they are borrowing from the bank unions a lot better than finance companies? Continue reading to ascertain.

What are the similarities anywhere between credit unions and you can banking institutions?

One to very important procedure such financial institutions have in common is actually safeguards. They are both federally covered. Credit unions try covered because of the Federal Credit Commitment Administration (NCUA), while banks is actually covered by new Government Deposit Insurance coverage Enterprise (FDIC). Both the NCUA and you will FDIC provide the exact same number of safety and certainly will guarantee the dumps up to $250,000. Very, if a business fails, you’ll be able to to get at minimum $250,000 of one’s cash back. You can rest assured it doesn’t matter if you select a cards commitment otherwise a bank.

At the same time, credit unions and you will banking institutions one another offer equivalent features for example savings and you can examining levels, online and cellular financial, family and automotive loans, company characteristics, debit notes and the like. Nonetheless they render perks and you can benefits on the members.

What are the significant distinctions?

The greatest difference between borrowing unions and you will banks is that borrowing unions are not-for-profit organizations which might be member-had when you’re finance companies try for-money and you may belonging to people. This may generate a change from inside the pricing and you will fees (more about so it inside the a little while).

Higher, regional or federal financial institutions tend to have a lot more towns and you may ATMs than just borrowing from the bank unions. This will build banking institutions far more convenient for folks who traveling a great deal or are now living in several metropolitan areas. Borrowing unions, at the same time, are usually element of a surcharge-free Atm network, in order to nevertheless stop extremely charges.

Another type of huge difference? While borrowing from the bank unions generally speaking require that you become a part in buy to make use of their characteristics, banks do not. not, the fresh new requirements to become listed on a card relationship are usually wider enough to add we, so it’s quite simple being a member and you can experience the brand new advantages of banking having a credit commitment.

Why are borrowing from the bank unions better than financial institutions?

Because they’re distinctively situated, borrowing from the bank unions promote plenty of positives over banking institutions, causing them to a better economic choice for a lot of people. Listed here payday loans Atmore are five reasons why borrowing unions can be better than banking institutions:

step 1. Borrowing unions aren’t-for-profit and you may user-had

We’ve already emphasized that it, however it was at the fresh new center out-of why borrowing unions was a step above banking institutions. Finance companies try belonging to buyers on goal of flipping a money via consumers-which is, accountholders, consumers and the like. This tend to causes highest can cost you on consumer.

Quite the opposite, credit unions is owned by professionals (members, consumers and stuff like that), perhaps not traders. Which means most of the payouts made at the credit unions is returned to participants in the way of ideal prices and lower costs And you will some of the functions come with no charges anyway. Indeed, of a lot borrowing unions still make it players to provide a bank checking account for free plus don’t wanted at least balance.

2. Borrowing unions enable it to be users getting their say

Borrowing from the bank commitment members can also be choose to decide board players in order to represent them which help make important behavior concerning strategic guidelines of the school. People have a state as they are region people, not merely account holders.

3. Credit unions purchase town

Since the borrowing unions won’t need to value purchasing stockholders, info and fund are made available to higher causes, specifically those next to family. Borrowing unions support a myriad of local, local and you can federal teams and you will recruit numerous area events.

Such as, Solarity Borrowing from the bank Connection prides by itself on the helping the Yakima area and you will the Pacific Northwest. This includes giving, creating and you can partnering which have casing jobs, healthcare facilities, colleges, humane societies, charities and you will groups which can be doing work into self-confident transform.

Investing in the city also includes taking financial studies and information. Borrowing unions may offer financial counseling and you can courses so that users produces most readily useful, wiser behavior.

4. Credit unions be more available, flexible and accommodating of their members’ needs

Credit unions promote examining and you may savings profile which have reduced if any minimum harmony standards. Remaining at least equilibrium from inside the a free account should be exhausting, especially when you are going due to monetaray hardship, and lots of banks charges fees in case the equilibrium is simply too lower. In the event that a card relationship has minimal balance conditions, it’s usually a reduced, a great deal more in check number. As well as of a lot borrowing unions, checking and you may discounts membership try 100 % free.

You are along with likely to become approved for a financial loan courtesy a cards commitment. Or even fulfill the requirements, pledge actually missing. Credit unions can be more flexible on the certain things, just like your credit rating or settlement costs. The object to keep in mind is that borrowing from the bank unions wanted professionals to help you rating loans and you can achieve the monetary goals.

5. Much more custom solution and you may a far greater partnership complete

And providing players a voice, borrowing from the bank unions also have a far more communal environment. After all, borrowing unions are included in your regional community. He or she is staffed of the society participants which comprehend the regional savings and you may housing industry.

The quicker dimensions also means you have made the right amount of desire. Borrowing unions are member-mainly based. They offer higher customer care on the a personal height. The staff will discover your title when you stop by.

Credit unions has actually employees who can hear your own facts, give choice and gives information. By contrast, you might not find that that have banks. Its rules are usually rigorous and you will inflexible. They will not take care to think about your unique disease.

Work on a cards Relationship

There are many reasons as to the reasons borrowing unions can be better than finance companies. And will also be capable of getting most of these rewards while also understanding you’ve got the exact same account options, comfort and you can quantity of protection because a lender. Now, it’s simply an issue of finding the right borrowing from the bank connection having your.

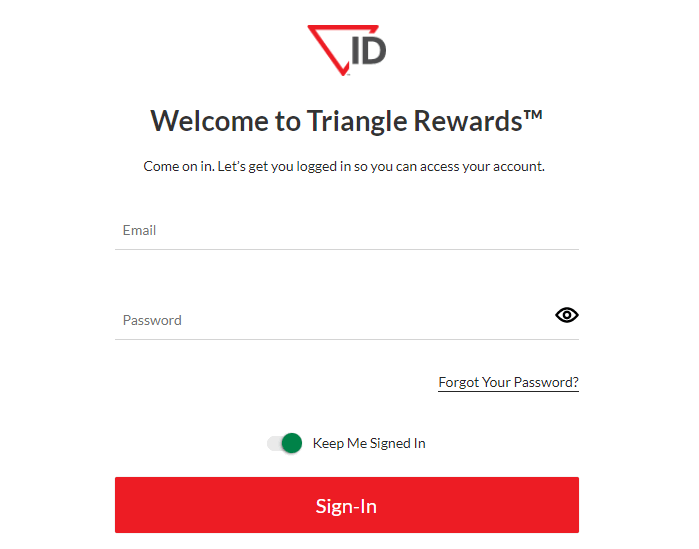

If you’re regarding Pacific Northwest, join Solarity when planning on taking benefit of the borrowing from the bank union benefits. You will find info on applying for Solarity Credit Commitment towards the the webpages. We made it easy, also. It takes merely a few minutes to apply on line. So, what exactly are you waiting for? Come experience the credit commitment variation for your self!

Our professional Financial Books try here to help

You’ll find nothing our house Mortgage Instructions like more enjoying players move into their dream home. We have been right here to store some thing as facile as it is possible (along with a completely on the web but really individualized processes)!