Consider the Downsides away from USDA Finance

Taking home financing with no downpayment and reduce credit requirements seem like a whole lot. You could potentially however receive lowest cost even in the event your credit rating try 640. But not, regardless of the gurus, take note of the downsides.

Very first, check out the place. This might not possible in case your job needs that drive with the area every day. Take into account the big date, pricing, and energy which can get. If you aren’t happier throughout the living away from area, you really need to get a hold of an alternative choice. Second, if for example the family is higher than the fresh median money in your area, you will possibly not qualify for good USDA loan. More over, it takes consumers to invest a yearly insurance policies make certain commission, and this must be covered the entire loan.

USDA funds together with comply with lowest safety and health criteria. This is why if you are intending to invest in a good fixer-upper, rigid appraisers loans Springfield may not agree your home. Lastly, USDA financing could only be used to have first homes. They don’t really approve financing to own investment property or vacation property.

Estimating Your own Mortgage payments

Of many consumers grab USDA money as 31-seasons fixed-price mortgages. The brand new expanded payment label lets them to borrow a bigger financing matter that have a lowered monthly payment versus less conditions. But how exactly really does a no downpayment apply to your money? Will it save you in the long run?

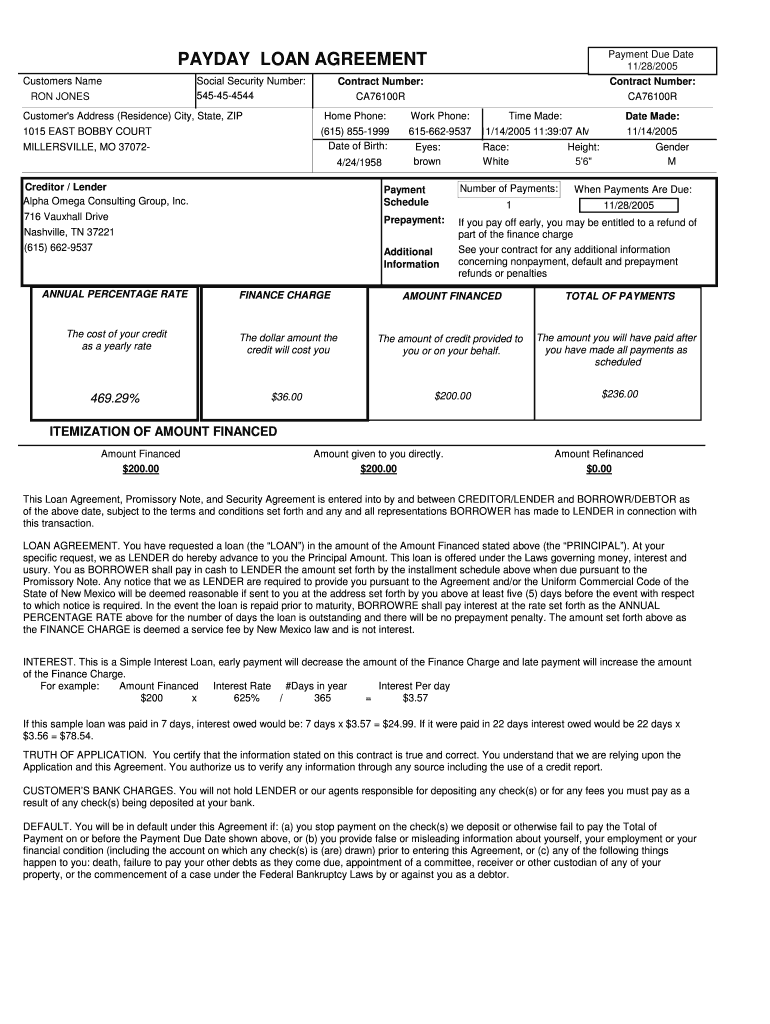

To find out, let us utilize the calculator above so you’re able to compute a good example. Guess your grabbed 29-seasons repaired-speed mortgage worthy of $two hundred,100000 at the step 3 percent Apr. Why don’t we compare the home loan repayments and you can full focus if one makes a zero deposit, ten percent down, and 20% off.

- 30-Year Fixed-Price Loan

- House rate: $two hundred,one hundred thousand

- Rate of interest: 3% Apr

In accordance with the desk, and work out a down payment decreases the matter you borrowed. It directly decrease the upfront ensure fee, which is one percent of your own amount borrowed. Instead of and work out a down-payment, their initial be certain that commission will be $dos,one hundred thousand. At the same time, a 10 percent off cuts back your initial payment to $1,800, and an effective 20 off commonly fall off it to $1,600.

The outcome also direct you result in the higher full month-to-month home loan commission ($step one,) if one makes zero downpayment at all. For those who shell out 10 percent down, so it reduces your own complete payment to $1,. Which is deals worthy of $ 30 days. While doing so, if you make 20% down, their complete monthly payment could well be less in order to $step 1,. That it helps you to save $ four weeks.

Also, deals are most obvious when we examine the entire focus charges. With a no advance payment, their overall interest cost to your 29-seasons financing could be $103,. Although not, if you pay 10 % off, possible pay just $93,, which means that you can save $ten, for the desire will set you back. And in case you pay 20 percent down, your total desire charge fall off so you can $82,. This means it can save you $20, than the perhaps not while making any deposit whatsoever.

The analogy implies that if you’re downpayment is not needed, paying it will help reduce your monthly mortgage repayments. In addition it somewhat slashes your total notice will cost you. While it’s tempting never to make a downpayment whatsoever, your sooner conserve a whole lot more even though you pay lower than 20 %. Having said that, it’s worthy of rescuing to have downpayment before you secure an effective USDA mortgage.

The bottom line

If you are looking getting sensible funding to live on away from city, you could make use of USDA funds. Such funds none of them advance payment and include lower credit rating certificates than traditional mortgages.