Property foreclosure & Homeownership

While you are up against foreclosures, it’s not just you. Centered on business experts, the entire number of property foreclosure by the time the current financial drama subsides would be ranging from 8 and you can thirteen million.

This new foreclosure procedure will be daunting for most people, therefore, it is critical to remember that there are possibilities available that enable you to keep your home otherwise sell otherwise transfer your home easily prior to a property foreclosure selling.

Property foreclosure Procedure

When lenders start a foreclosure with the a property, the process is often official otherwise nonjudicial, depending on just what condition you live in. Per county provides their own band of measures and factors. When you look at the a judicial foreclosures, the procedure knowledge the new state’s courts. Right here, a loan provider constantly data files a lawsuit and then tries to convince a judge why the new homeowner’s standard should allow the lender so you can foreclose and take the house. During the a beneficial nonjudicial property foreclosure state, new property foreclosure happens without any involvement otherwise oversight of any legal. Here, homeowners cannot boost protections unless of course he has got legal counsel, just who documents a keen affirmative-action from inside the legal, desires a keen injunction to avoid brand new foreclosures, posts a thread (have a tendency to thousands of dollars), and you can persuades a courtroom so you can enjoin the brand new foreclosures.

Safeguarding oneself facing a foreclosures shall be a complex processes from inside the one condition. While you are threatened that have property foreclosure, i encourage acquiring legal assist quickly to guard your own rights. This is eg crucial if you believe that you will find become taken advantage of because of the financial or may be the sufferer of a property foreclosure relevant fraud.

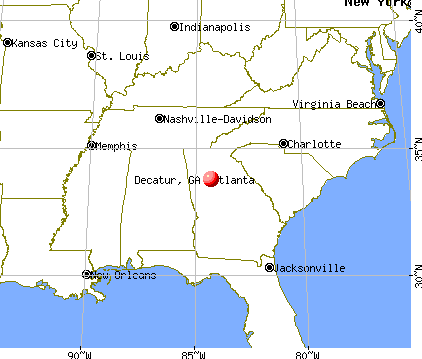

NACA have attorney all over the country who are dedicated and ready to include courtroom direction concerning foreclosures items. Select a lawyer.

Government Software

In early 2009, this new Federal government observed new To make Home Affordable Program (MHA), with opportunities to help keep families inside their property from the switching otherwise refinancing their family members’ mortgage. The brand new Administration’s chief foreclosures-recovery system ‘s the Domestic Affordable Amendment Program (HAMP), which is made to provide bonuses for servicers to reduce homeowners’ month-to-month home loan repayments with mortgage modifications. No matter if HAMP is made to help homeowners, the capability to keep home would depend significantly towards the competence and you will union of mortgage maintenance company, your ability to track down judge help, plus time and effort for the a procedure that is often hard and challenging.

For lots more user information about HAMP or any other government foreclosure-relief and you will homes programs, you can browse the pursuing the other sites:

Property foreclosure Rescue Scams

Maybe not which is also, the subsequent rise in property foreclosure cost keeps contributed to a rise in the save yourself frauds. This new alleged rescuers fool around with certain cons having devastating consequences getting currently hopeless property owners. If you find yourself looking forward to this new guaranteed save you to definitely never happens, homeowners are not just ripped off out-of several thousand dollars one they can’t free, but also slip better for the default and you may dump precious time when you look at the protecting their houses off foreclosure.

- Bailout: Here the fresh new scam artist takes care of the new standard count in return for the newest citizen surrendering brand new identity to their home. The fresh citizen will be informed they could book their property back in the scam artist up to they are able to repay what is actually due. At some point, around unconscionable leasing terminology the fresh new resident non-payments, was evicted, and you will loses all the collateral in their home.

- Bait and you can Option: So it ripoff occurs when the citizen will not realize he is surrendering possession out-of his household in exchange for a beneficial save your self. Sometimes the latest sale data are forged or perhaps the citizen was led to think that he’s merely signing data to have a special financing to really make the mortgage newest.

- Phantom Help / Loan modification Specialist: Right here brand new going rescuer charges very high charge for first cellular phone calls and you may records that homeowner have complete himself. Or, the fresh new rescuer make promises to show the new resident from inside the transactions on the bank, however, will then do nothing to save your house. All these fraudsters have fun with deceptive methods to business its services because the a joint venture partner bodies-focus on mortgage loan modification program although this is the furthest thing regarding knowledge.

Fundamentally if this music too good to be real, this may be always is simply too best that you getting correct. When you yourself have questions regarding a package you are entering, keep in touch with a lawyer or a construction therapist basic! If you feel you have been a target out-of a foreclosures save yourself swindle or other foreclosures scam, contact:

- Government Change Payment (FTC) or from the cellular phone within step one-877-FTC-Assist (1-877-382-4357);

- Your state Attorneys General’s office.

Opposite Mortgage loans

Reverse mortgage loans are another style of home loan that allow property owners more than sixty-two move this new equity in their home toward dollars without to offer their homes. Such loans are popular choices for older persons as they offer a finances supply, which will surely help fulfill unanticipated scientific costs https://paydayloancolorado.net/eldora/, build renovations, and you may complement Social Cover and other expenditures.

Unfortuitously, while the rise in popularity of contrary mortgages grows, very does the potential for ripoff. Predatory lenders, unscrupulous financing agents, and unethical agents get address elderly people whom may be stressed regarding their economic shelter. Deceptive means and allegations regarding higher-tension conversion process tactics are more often discovered just like the seniors are taken advantage of within the guise away from a helpful and you will legitimate contrary financial.

If you’re considering an other home loan, you ought to store aroundpare the options plus the conditions various loan providers promote. To learn more facts about opposite mortgages go to:

In the event you that a person involved in the opposite mortgage purchase could be breaking legislation, allow bank otherwise mortgage servicer know. Next, document a problem that have:

- FTC: 1-877-FTC-Assist (1-877-382-4357)

- Your state Lawyer General’s place of work or condition banking regulatory agency.