What things to Consider when you look at the Forbearance

Forbearance symptoms are supposed to become a short-label substitute for let home owners avoid property foreclosure. Residents taking advantageous asset of mortgage relief, not, need ultimately reenter typical payment dates, which includes the fresh new countless People in the us just who registered forbearance during the new COVID-19 pandemic.

During forbearance, you might however promote your home. Some home owners you will imagine offering whenever they try not to continue to make mortgage repayments whenever forbearance finishes, when planning on taking advantage of higher home values, and for numerous other explanations.

It doesn’t matter the reason why you need to promote, it is critical to note that even although you promote, the lending company might possibly be owed a complete number that you don’t repay.

Find out how attempting to sell a home while in forbearance work, be it helpful for your, and what selection you have got to own staying in monetary fitness if you find yourself appearing out of forbearance.

Trick Takeaways

- Home loan forbearance provides struggling people a reprieve of the pausing or lowering mortgage payments to own a set amount of time.

- You could potentially however offer your property no matter if you’re in the latest forbearance period, but the complete amount of your debts would need to be repaid.

- If you’re unable to sell your house while in forbearance, you could potentially mention other available choices including deferment, mortgage loan modification, and you can refinancing.

What is Home loan Forbearance?

Forbearance is a trouble program where a home loan company allows the fresh borrower pause otherwise dump the money for a short span of your energy.

Forbearance offers the parties an air months which have sometimes lower or zero money in which indeed there are not a foreclosure already been, while the citizen can become most recent once more, Andrew Lieb, a https://www.paydayloansconnecticut.com/staples/ lawyer focusing on real estate and you can author of 10 Measures to purchase Property Article-Pandemic, advised The bill in the a phone interview.

Inside the COVID pandemic, if CARES Act offered a much easier approval process, many residents grabbed advantage of forbearance to track down straight back towards its ft. Based on financial-data seller Black Knight, 790,100 lenders remained for the forbearance since .

Home owners have to get forbearance, describing its condition and you may getting one requisite paperwork. If the acknowledged, there’ll be a good forbearance arrangement where in fact the borrower promises to repay all skipped payments. While the forbearance ends, installment words can differ.

For every single financial servicer features their own forbearance preparations and you may arrangements founded on borrower’s financial facts, it is therefore best to consult her or him straight to weigh all the of possibilities, Jason Vanslette, a partner which have Kelley Kronenberg based in Fort Lauderdale, Fla., told The balance for the an email.

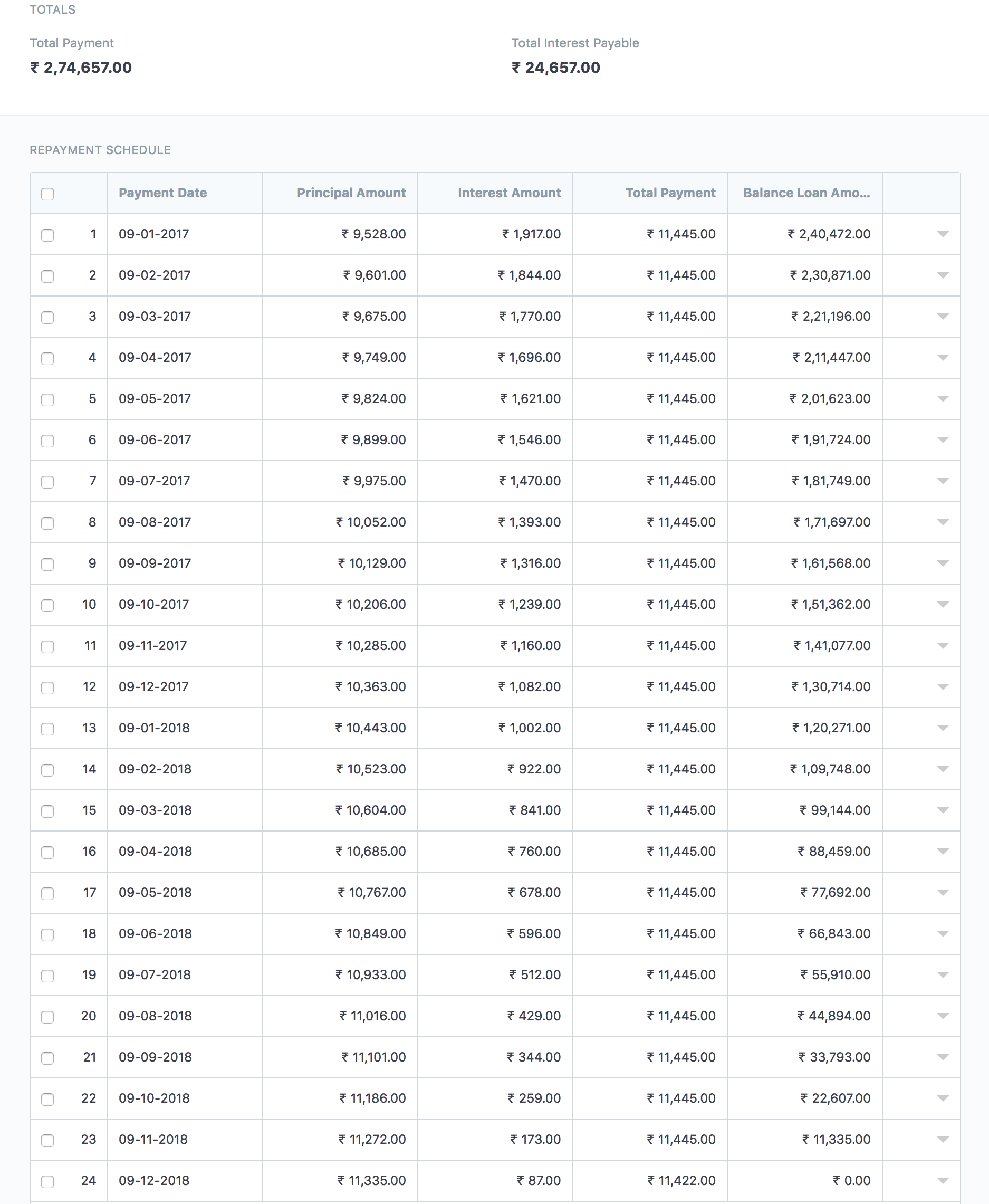

Normally, forbearance agreements begin at the three to six days, and you will individuals is also inquire to give the definition of as required. Focus constantly continues to accrue throughout forbearance, and you may nearly all forbearance agreements wanted full payback of one’s deferred numbers (sometimes quickly or over a period), Vanslette said. There will additionally be late charges tacked on the if the forbearance package are registered immediately following a first default.

Forbearance differs from deferment, the latter of which allows individuals to move any skipped money towards prevent of one’s mortgage. In some cases, the lending company get commit to a good deferment when consumers turn out away from forbearance.

Selling a house throughout forbearance is possible, and it also could be an effective monetary move for the majority consumers who can not afford payments whenever forbearance ends up. The main suggest bear in mind is the fact most of the deferred quantity and you will accruing attention should be paid in complete before you earn any cash on deals.

Thus, you’ll want to know if the collateral in the home try confident otherwise bad or if or not you might promote that have money. Eg, in case your home is appreciated at $500,000 therefore owe $400,100, you could potentially offer during forbearance and you will recover in the $a hundred,100.

Offering during forbearance is more complicated for you financially if you’re upside-down to your mortgage, meaning your debt more about the loan than just you may get from the deals of the house. In that case, you may need to encourage the lending company to do a primary sales, Lieb said.

Other options To consider

If the offering your property actually an option, however are worried on exactly how to pay back the forbearance, you actually have other options.

Mortgage servicers are extremely seeking selecting choices so you can foreclosures and you may give a number of adjustment based the being qualified financials, Vanslette said. Getting in touch with your own mortgage servicer and you will asking for an amendment application is the newest 1st step to this procedure and you can a normal practice with quite a few individuals.

Such as for example, you can test working with the lender into the giving a repayment deferment or financing modification, and this alter your loan terms.

An alternative choice was refinancing, however it might be tricky, especially if your borrowing has taken a knock. Specific lenders may wanted a standing up period for as long as one year, during which you would have to make straight for the-time repayments on the home loan. not, if perhaps you were during the forbearance underneath the CARES Operate, you are eligible to re-finance within three months immediately following the forbearance comes to an end if one makes around three consecutive money.

Lieb in addition to recommends looking at unique programs that is certainly readily available in your condition or county, however, make sure you exercise before you could standard. When you skip money, the financial interest increases so you’re able to a penalty speed, and you may most likely eradicate any eligibility to help you qualify for assist, he states.

To buy a house Shortly after Forbearance

Immediately after dealing with a crude plot the place you have confidence in forbearance, you’re thinking how it you will impression your future ability to obtain a mortgage. Really consumers normally have a standing up ages of to twelve days, according to the the new loan’s conditions.

At the same time, the credit wreck that the forbearance features can possibly prevent anybody regarding providing accepted to have a new loan. (In the pandemic, property owners experienced zero borrowing impression. So when long because they make three consecutive repayments after the forbearance, he could be permitted go shopping for an alternative financial.)

Sooner, in the event that a lender notices you’re inside forbearance, it view you as the a high chance whilst implies you was basically toward shaky financial ground. For this reason, chances are high you may need to slow down any coming domestic-purchasing preparations for a while.

Frequently asked questions (FAQs)

Residents need to proactively contact its loan providers to consult forbearance. Only telephone call and ask to speak to help you someone who handles financial recovery alternatives. Anticipate to define your financial situation, and have concerns to choose in the event the forbearance ‘s the proper solution for your requirements.

How does home loan forbearance connect with your borrowing from the bank?

Mortgage forbearance might have a life threatening bad influence on your own borrowing because missed costs can be technically feel advertised because delinquencies to the credit bureaus of the lender. New exception is if you used to be offered forbearance in CARES Work for the pandemic just like the loan providers has conformed never to declaration this new paused money as negative pastime.