Making an application for a good HomeReady Mortgage

- Compare Financing Features: Start by contrasting the features regarding a beneficial HomeReady real estate loan having almost every other financial solutions. Remember that while you are HomeReady allows for low-down payments, rates would be greater than specific antique finance. Checking out these circumstances assists know if the benefits exceed the expenses.

- See Eligibility Criteria: Knowing the methods in the choosing money eligibility is key. HomeReady mandates money limits, credit score standards, and you will a great homeownership education movement. For folks who satisfy such certification, you are on just the right tune. Or even, trying information away from a home loan advisor is a good step two.

- Compare Mortgage lenders: Whilst HomeReady system is actually a fannie mae effort, fund commonly considering really from the Fannie mae. You will need to find an outward lender-such a local bank or an on-line lender. Contemplate, specific loan providers may well not render these mortgage, making it crucial that you comparison shop.

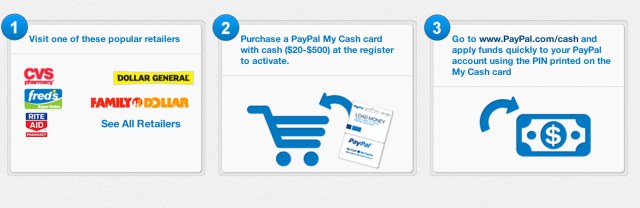

- Submit The loan App: The program relates to filling in models and you will submission paperwork, such as proof income and tax returns. Electronic systems you are going to render quicker operating using actual-time economic data confirmation.

- Loose time waiting for Loan Recognition: Just after applying, loan providers evaluate debt balances and you may creditworthiness. Bringing acknowledged will bring information just like your rate of interest and you may mortgage count, paving the way in which to own home browse otherwise and come up with an offer. If the software is not successful, mention other financial choices together with your coach.

Knowing the full-range regarding financial possibilities is key for potential people. Several popular choices for the HomeReady mortgage, hence spends a methodology for the deciding money eligibility, was FHA money and Freddie Mac’s House You can system. For each and every also offers distinct masters and serves different borrower means.

Researching HomeReady Fund that have FHA Fund

When you’re HomeReady fund assist in homeownership www.paydayloanalabama.com/beatrice identical to FHA fund, it appeal to other borrower users. While you are entitled to a great HomeReady mortgage, you could also qualify for a keen FHA financing. But how can you decide which a person is more suitable getting your role?

FHA finance were aiding tenants because the 1934, especially those having restricted downpayment tips. The FHA needs the very least downpayment off step three.5%, marginally greater than HomeReady’s step three%. These two mortgage programs, regardless if equivalent in downpayment, differ somewhat various other portion.

When to Opt for an enthusiastic FHA Loan Over HomeReady

FHA funds are ideal for individuals that have down credit ratings. You might secure that loan that have a beneficial FICO rating while the reduced once the 580 and you may good step three.5% downpayment. Actually those with results between 500 and you will 579 get be considered with a ten% downpayment. New FHA’s support enables loan providers to give advantageous terms to people with straight down borrowing.

Advantages of choosing HomeReady More than FHA

HomeReady stands out with its liberty inside money confirmation. Lower-money consumers can put on with co-individuals if you don’t include extra cash, instance lease of a great boarder, without the need for this new renter on the application for the loan. However, proof one year off cohabitation towards the occupant required.

A serious advantage of HomeReady, are a normal loan, is the power to terminate private home loan insurance (PMI) just like the financing balance falls so you can 80% of the house’s worth, potentially cutting monthly obligations. On the other hand, FHA finance care for mortgage insurance rates with the longevity of the borrowed funds unless of course good 10% down payment is done.

It is critical to keep in mind that HomeReady needs candidates to possess a keen income that will not surpass 80% of one’s area’s median income.

HomeReady in the place of Domestic You can easily

- Allow a great 3% downpayment.

- Lay an income limit within 80% of the area’s median money.

- Was friendly into the co-borrowers.

However, our home You can easily system generally requires a minimum credit score regarding 660, whereas HomeReady is usually open to people with a beneficial FICO score out of 620 or more.