- Had written for the

- seven min discover

Richard Haddad is the administrator publisher away from HomeLight. The guy works closely with an experienced articles class one manages their weblog featuring into the-breadth blogs regarding property and you will promoting process, homeownership news, home care and you can construction resources, and you will related a home fashion. In earlier times, he supported as a publisher and you can posts manufacturer to possess World Company, Gannett, and West News & Info, in which the guy in addition to supported given that information director and manager of sites functions.

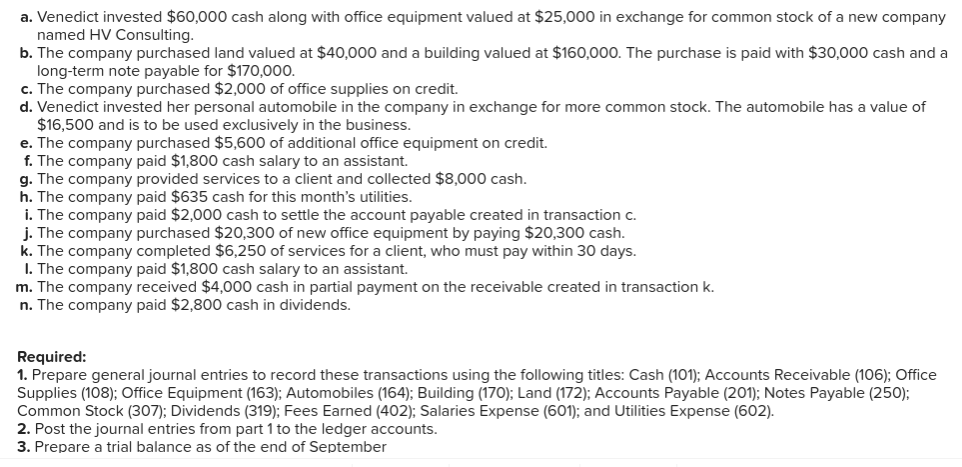

Before couple of years, home values on the U.S. enjoys increased by 47%. This means that, property owners try together looking at near to $33 trillion in home guarantee – and many is capitalizing on that it windfall by way of collateral-backed loans. That it begs practical question: Was home security loan attention tax-deductible?

Such as for instance so many something moved of the Irs, the newest agency’s respond to can also be voice state-of-the-art or even not clear. Contained in this short-term blog post, we make clear and you will explain an important rules. It all begins with a less complicated question: How could you be expenses the loan fund?

Just how much Is the Family Value Now?

Home prices has actually rapidly improved in recent years. Simply how much is the current household really worth today? Score a ballpark guess regarding HomeLight’s 100 % free House Worth Estimator.

Was household guarantee mortgage appeal tax-deductible?

This means that, taxpayers is deduct the attention towards the property equity financing otherwise domestic guarantee personal line of credit (HELOC) oftentimes when they utilize the currency so you can redesign otherwise increase the property you to backs the fresh new guarantee mortgage.

You will find extra laws and regulations and you may restrictions towards highest or combined guarantee-recognized mortgage quantity. But since the average equity mortgage removed from the You.S. residents is just about $100,000, plus the mediocre HELOC harmony is all about $42,000, most People in america don’t have to claw from limits for write-offs with the the residential personal debt spelled in Internal revenue service Publication 936.

Appeal to your house equity funds and credit lines is actually allowable as long as the mortgage are acclimatized to buy, generate, or drastically improve taxpayer’s household you to secures the loan. The loan need to be covered by the taxpayer’s main family or next domestic (qualified household), and you can see most other standards.

From inside the Internal revenue service terminology, that it accredited focus you have to pay towards the lent loans is classified because the family order debt. These types of laws affect money borrowed having income tax decades 2018 owing to 2025. Later on this page, we shall give a compact point addressing currency lent prior to 2018 and you will once 2025. (Sure, the fresh new Irs have a tax code window for it, however, we’ll make clear that, too.)

Do your home guarantee mortgage meet the requirements?

Less than so it buy, generate, otherwise drastically improve take to, you might subtract domestic guarantee loan or HELOC focus when the the lent cash is employed for the next:

- Pick an initial or 2nd domestic*

- Build a primary otherwise second house

- Generate renovations into the number one otherwise 2nd household

*A professional 2nd house need to still be a first home, like a secondary family in which you indeed live, perhaps not accommodations or income assets having renters.

If you utilized the borrowed money to have whatever else, including debt consolidation, to invest in an automible, boat, otherwise Camper, otherwise paying for your daughter’s wedding, you simply cannot deduct the borrowed funds attention.

To put it briefly, by using the amount of money to possess a qualified restoration or resolve with the a qualified house, you might deduct some otherwise your entire domestic collateral loan otherwise domestic guarantee personal line of credit (HELOC) desire on the fees. The test starts with the phrase pick, make, or significantly increase and you will just what percentage of the borrowed funds currency was utilized to that objective.