Whenever beginning work with your own structure jobs, discover work that have to be over before you even split floor. Investment, are precise. Whom you choose for that jobs can also be at some point alter the way of one’s job alone. Best bank produces the entire process smooth, transparent, and also as as simple it can possibly be. You’ve got the money in hand towards the amount borrowed, a detailed occupations suggestion, and you may a concept of what you’re looking from inside the a fund companion. You know what kinds of loan choices you are in the latest marketplace for. Just what else do you perhaps need?

The way to determine if a lender excellent to own you is through asking suitable concerns. A monetary institution’s response to inside-depth browse and they probing issues will say to you whatever you want to know. Particularly when you are considering household construction money, you need the very best financial companion to see they owing to towards stop.

1- Really does The financial institution Render Construction Money As An extra Product In order to Feel Complete Service Or perhaps is So it A passion for The financial institution?

You really need it as an enthusiasm to be sure the better choices for your family. Structure loan lenders have to have a discussed passion for their sight therefore the investment, it can promote them to top any barriers one to arise during the fresh new lifespan of one’s mortgage up to framework is done. Their ability to afford price of the borrowed funds actually from inside the matter – its their conviction that’s.

After you have the answer, choose whether to just do it. Two of the poor steps you can take are proceed if the do you really believe one thing is not proper, otherwise just do it because if some thing try incorrect whenever nothing is.

2- Really does the bank have appraisers that have experience with custom home for the loads or home?

The response to which question for you is crucial. If you do not has a skilled appraiser yourself, brand new bank’s connection with a licensed appraiser will save you a good significant problems. Even worse, for those who look for a lender with an unskilled appraiser, you are nearly protected a lesser appraisal worth otherwise a delayed appraisal time period. The loan officer could offer all to you sorts of build financing it wouldn’t count while you are declined the means to access a keen educated appraiser.

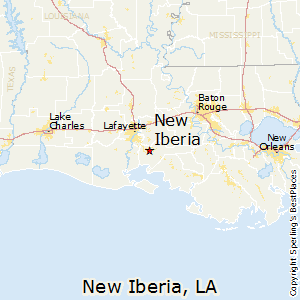

3- Do you know the portion the financial institution might possibly lend?

This really is secret due to the fact finance companies usually have limitations so you can how much cash cash in anybody town he or she is prepared to provide into the customized residential property on confirmed day. You’d like to learn this limitation as soon as possible so you’re not throwing away go out rotating their rims having a financial who can not provide you with what you want. This will end in a professional visitors getting refuted.

4- What kind of build money does the bank carry out?

Discover different types of you to definitely-go out close and you will antique framework fund. Manage they assistance FHA, Va and other authorities-guidelines established loans? It is essential to see its choices, this new scope of them financing, and their expectations of your with regards to per loan.

Go after all that with a concern inquiring regarding the the various other costs if for example the visitors really does usually the one-big date intimate. Following that you will discover which ones could possibly get work most effectively provided your options:

- Construction-Simply Mortgage: This type of financing merely covers the cost of the development, perhaps not a supplementary mortgage. If you find yourself doing most of the works oneself, this can be a costly choice since you find yourself investing numerous categories of payday loan Mobile charges and you can potentially large interest rates.

- Design so you can Long lasting Financing: That loan designed to supervise the building off a home and you will end up being changed into a permanent mortgage due to the fact home is over.

- Home Guarantee Loan: This utilizes the value of your house to generate the fresh new financing, utilising the home by itself given that guarantee. It produces a swelling-contribution payment that you pay back during the a fixed price more an agreed-through to time.

- Identity money: This can be a from the-the-publication financing that the identity spelled out, customized little. The fresh fees plan and commission plan are discussed while the interest shall be both repaired otherwise drifting depending on the words.

5- Does the lending company has that loan panel having a passion to possess build loans or will they be traditional so you can approve them?

You could potentially find out about the financing recognition price, how detailed the loan process is, just in case this might be a task they will generally speaking accept. From the focusing on how many equivalent money they approve per year, like, you could regulate how likely he or she is to provide the loan app.

6- Are they in a position to stick to the mark agenda the fresh new creator have within their package?

It a far greater talk towards creator to have for the financial, but usually a good question to acquire an idea of whether or not the system is versatile or rigorous.

7- How much time really does the customer have to pay off of the build financing?

That is an essential concern to ask which help you narrow off potential financing. According to the regards to the latest funds, reduced loans may need high interest money that may not worthwhile to you. We wish to understand timeline of your own loan, while you are expected to create focus only costs, or other good info whenever choosing that loan.

8- When the create date is higher than the latest offered time for the development mortgage, exactly what options really does the bank need expand the mortgage?

Design go out tables will never be simpler for anybody. Even with an educated construction teams and you will auto mechanics on your side, you could work with trailing. They might enforce even more penalties, higher pricing with the longer period of time, otherwise that they ifications ahead will assist you to make a told choice.

9- Does the financial institution allow link money?

Or have options for the customer to make use of the equity within the the newest the place to find advice about new down payment? The latest changeover away from temporary in order to a lot of time-name resource can be exactly as crucial since the mortgage alone if go out try of the substance and you ought to safer that loan punctual.

So now you See

Now that you learn some of the best issues to inquire of, you may be a whole lot more advised than in the past. Equipped with such solutions, you should have certain real methods to consider whenever narrowing down debt couples for your framework mortgage as well as have you also closer to completing your home enterprise. Use these concerns while the answers a financial will bring to obtain the financial institution that suits the structure financing demands!