Lennar is rated Zero. 119 to your Chance five-hundred

As a result into the ongoing mortgage rates amaze, homebuilders around the a lot of the world enjoys used a proper means to trigger family sales through providing web effective rate incisions. This approach really stands inside the stark examine towards the current real estate market, in which house vendors in most markets, particularly in the fresh new Midwest and you can Northeast, was indeed reluctant to down their prices.

Although some builders have turned to help you simple price decreases (KB Home President Jeffrey Mezger informed me which is their taste) or cash incentives on closing, the best tactic one of many well-known builders provides financial speed buydowns outgoing (D.R. Horton Chief executive officer David Auld told me that is their taste). These types of buydowns, varying during the duration, has actually showed their potential to incentivize potential customers. Certain promote short-term price decrease on the first age, although some continue the advantage about entire financing name.

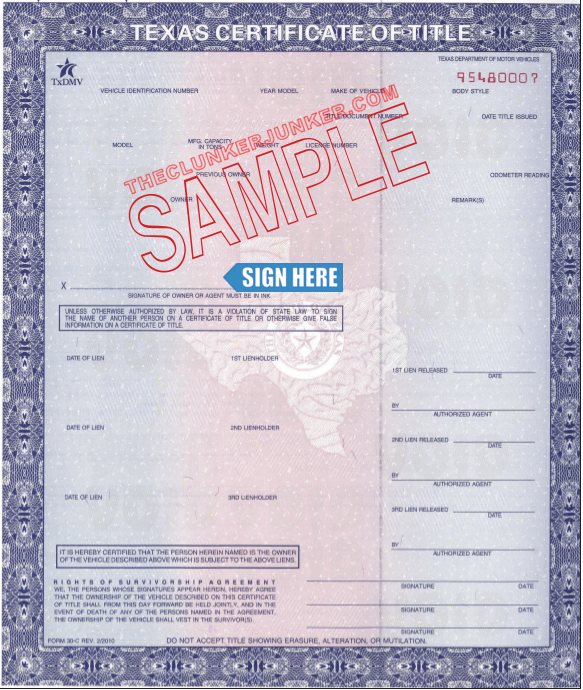

You to definitely notable example is inspired by Lennar, a homebuilder currently ranked Zero. 119 into Luck 500 record. Lennar is actually actively generating a americash loans Cos Cob conventional mortgage having a predetermined rates regarding cuatro.75%, or $33,500 on settlement costs, during the get a hold of Tx communities. This provide out of Lennar is true for these just who sign a purchase contract on the a choose move-during the in a position house inside Colorado ranging from and .

What is fascinating? To the Sep nineteenth, Lennar is actually ads a great cuatro.25% buydown when you look at the Tx. So over the past week, just like the mortgage pricing possess ticked closer to 8%, Lennar provides went their buydown out-of 4.25% so you’re able to 4.75% inside Colorado.

It isn’t just Lennar, take a look at this tweet from the Rick Palacios Jr., director off research at the John Burns Browse and Contacting. It suggests that PulteGroup, an excellent homebuilder rated Zero. 259 to your Luck 500, even offers drawn right back on their buydown has the benefit of. Heading off 4.99% in April, so you can 5.75% since Oct.

Arrived makes it simple to invest in shares away from leasing home, enabling someone to secure couch potato income and you can benefit from value of prefer. Merely choose from all of our wide array of higher-top quality rental property and purchase anywhere between $100 and you can $20,000 in the for each property.

Arrived handles the administration & functions, in order to sit back and construct money. Arrived try backed by world-class traders and additionally Jeff Bezos & Marc Benioff.

It would appear that some designers was scaling back their buydowns because spiked mortgage cost, having risen off the common 29-12 months repaired mortgage rate out of 7.15% to the August 1st in order to eight.66% as of today, have raised the expense of offering buydowns over the past several days.

It buydown pullback, in addition to fact that particular borrowers are receiving quoted mortgage pricing which have an 8 manage, may cause new house sales so you can once more pull back.

Back to early August an ohio homebuilder informed me one Men and women are of course accustomed these types of [mortgage] rates now… some one [homebuyers] try to buy dirt thinking [mortgage] pricing would-be lower by the time their home is carried out. A total 180 regarding last year.

But not, when i attained over to you to definitely same Columbus-depending creator into Tuesday, he’d an even more somber tone: “October might have been a beneficial ghost urban area. September is actually very hectic but that is as soon as we work on all of our annual promotion. We had been spending 3 factors into the resource having homes that can romantic this season and a few $ from the domestic”

New grounds enabling these types of well-known homebuilders, such as for example Lennar and you can D.Roentgen. Horton, to implement instance aggressive buydowns is the constant solid income. Such profit margins consistently exceed pre-pandemic membership, giving them this new monetary independency needed to take part in strategic efforts to increase conversion while making homeownership significantly more doable during these turbulent minutes.

Casing cost is so troubled one to Lennar has to offer a fixed cuatro.75% financial speed from inside the Tx

My standard outlook? If mortgage pricing continue steadily to hover up to 8%, there is going to be a great deal more downwards stress with the builder margins, especially if they feel obligated to once more expand affordability alterations, like offering extra money at the closure if you don’t implementing downright rates cuts.

Many thanks for subscribing to ResiClub! Absolutely nothing within this current email address is meant to act as monetary suggestions. Do your very own browse.