EMI, or Equated Month-to-month Installment, is the monthly payment away from a mortgage you create so you can the financial institution. It percentage comes with both the fees of your prominent count and the attention towards left mortgage harmony.

The expression Pre-EMI is utilized while you are discussing functions nonetheless under framework. This kind of things, the loan was paid in some values, according to ount you pay into creator.

Generally, starting with expenses only the interest rate into paid loan amount (called pre-EMI attract). If you’d like to start principal cost immediately, you could potentially separate the loan and commence spending EMIs towards accumulative numbers paid.

Idea 6: Learn Financing Period Possibilities

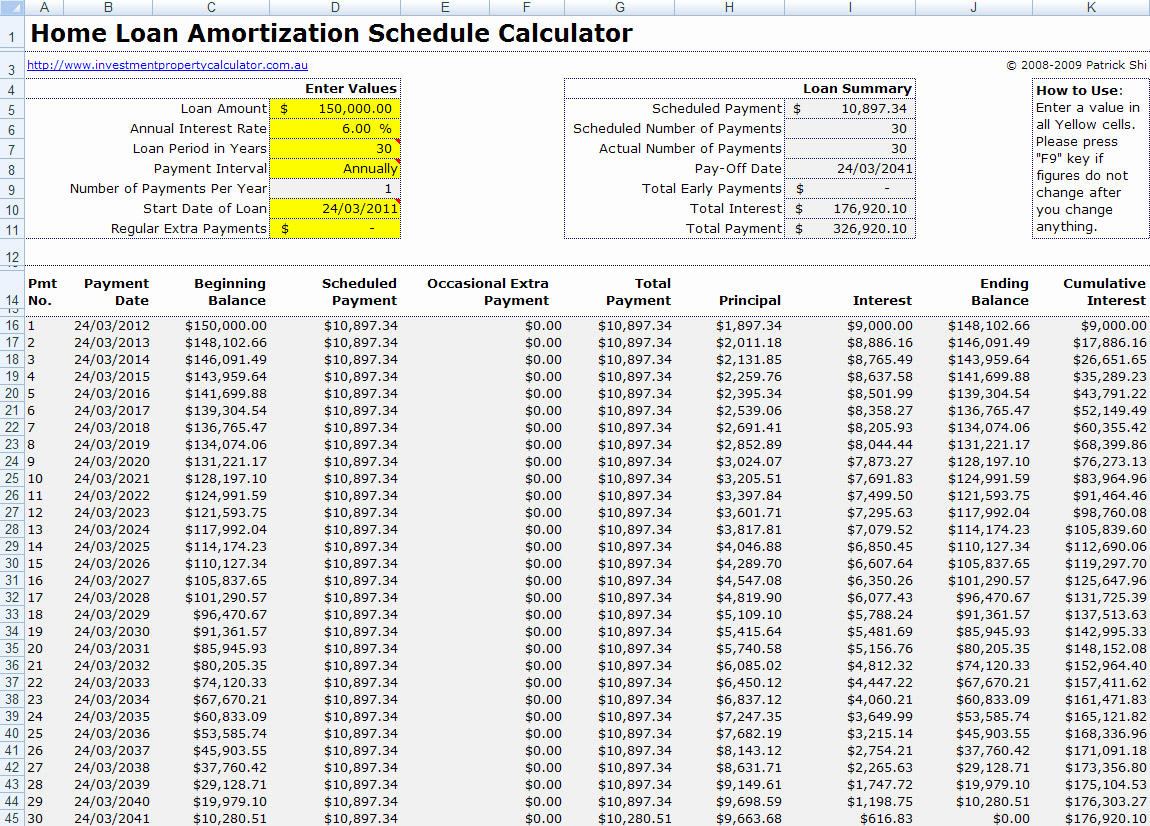

This time in the example of lenders is commonly overlooked, but it is important to keep your attention toward mortgage tenure. Although mortgage brokers try much time-label loans but deciding on the suitable tenure is a must since it make a difference the amount of focus you’ll be purchasing. That have a smaller period, their EMIs increase, nevertheless notice you are supposed to pay will get lower.

On the other hand, when your tenure try outstretched, the general interest repaid on your part could well be large, hence boosting your total repayment number. Financing tenure can also change the qualified amount borrowed; a longer tenure normally produce a larger amount borrowed but have a tendency to and fill the eye pricing. Thus, it’s a trade-off that must be meticulously well-balanced.

What if you’ve got taken out a home loan of around Rs 70 lakhs, nevertheless financial only recognized Rs fifty lakhs predicated on the eligibility. In this case, you are designed to lead Rs 20 lakhs from the money. It upfront payment are common just like the advance payment.

You should target a down payment as possible afford in the place of straining your budget. This should help you slow down the total amount borrowed. The smaller the loan matter, new smaller appeal youre meant to pay. Specific financial institutions actually offer 100% investment of the house really worth, which depends on the qualification. However, to minimize focus can cost you and to make certain down repayment, you might want to go for no less than a ten% to help you 20% deposit.

Owning a home is a significant economic action for many people inside their lifestyle, and many enjoys a robust psychological want quick cash loans in Leeds to make home debt-100 % free as fast as possible. Hence, they are paying off the mortgage before to minimize the loans personal debt. Pre-costs takes the form of region-money, your local area and also make a size percentage into the principal matter, or property foreclosure, that requires paying a complete loan amount until the financing tenure even comes to an end.

To make area repayments whenever possible can be reount of interest you’re designed to shell out and help in order to become loans-totally free sooner or later. Extremely banking institutions and you will construction boat loan companies are not imposing one pre-commission and you will foreclosure fees shortly after a specific period otherwise immediately following a beneficial particular part of the mortgage is actually reduced.

Yet not, particular loan providers charge you to have pre-payments as well as put restrictions on the number of pre-costs it is possible to make, additionally the complete pre-payment count. Thus, before attempting so you’re able to safe a loan, grasp the pre-percentage charge and only go for a lender who it allows pre-money with reduced to help you zero charges.

Idea 9: Pre-Acknowledged Financial

For many who haven’t yet , finalized one assets, it is worthwhile to get pre-acceptance for your house financing. Good pre-approved financial can show your a definite picture of your own borrowing ability, that may support you within the best settlement which have possessions developers. it may clarify the borrowed funds-getting process.