You actually has a good aim once you borrow money, however, cash don’t usually work out while the structured. A job change or health skills can very quickly place your from song, and eventually you may default on your funds. It’s important to know how defaulting affects debt health.

Precisely what does It Mean So you can Default into a loan?

Put differently, that loan gets in default if the debtor fails to spend the money for bank for every single the fresh terms and conditions regarding 1st loan contract. The time body type prior to standard kicks for the may differ from financing to some other. For people who skip an installment or several, you can also happen charges, along with your financing tends to be designated just like the “outstanding,” however, usually you can come back to a beneficial updates by making a great complete fee inside a fair length of time. Although not, if you’re unable to spend entirely from the terms of your own initial package, then you’re theoretically inside the standard.

Standard Mortgage Standard Effects

Breaching that loan bargain comes with outcomes. Defaulting directs a red flag to other economic agencies you aren’t an established borrower, and will never be reliable in other points as well.

Damage to Your own Borrowing from the bank

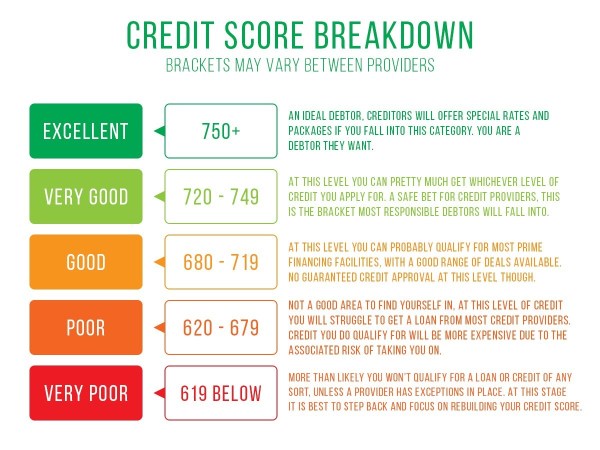

For individuals who belong to standard, your own credit will surely suffer. Your credit score is comprised of of numerous points, but the most significant will be your payment record. This consists of your own condition with all a great membership, loans, playing cards, or any other lines of credit.

Particular loan providers statement delinquencies whenever you are later towards the a statement. Toward earliest thirty day period after a payment arrives, you are probably from the obvious, but missed payments that lead to help you default might possibly be advertised to credit agencies, leading to lower fico scores.

Reduced credit ratings could affect numerous regions of your life. You might have a difficult date renting, in search of a job, joining utilities and you can smartphone services, and purchasing insurance rates.

Enhanced Costs

Defaulting can also increase your debt. Late fee charges, punishment, and you may judge costs was set in your bank account, raising the total ?harmony you borrowed from.

In fact, because of the outcomes of compound appeal, the loans increases easily. When you miss payments, your month-to-month appeal fees try added to the principal equilibrium of the borrowed funds; future attract will then be recharged with this deeper equilibrium, that will quickly snowball.

Legal issues

Whenever everything else goes wrong, loan providers publish outstanding expense so you can collection agencies. Selections could harm your own credit, bear courtroom judgments, and can are expensive. In certain sad circumstances, debt collectors can be very a nuisance, also.

For the an incident that have a courtroom judgment, a loan provider might be able to garnish your wages or even just take assets from the bank account.

Outcomes Centered on Financing Sort of

According to the types of loan, defaulting pulls additional specific effects. Some loans come with a built-for the band of remedies for default, and lots of trust trust by yourself.

Secured finance

In the event your financing is actually protected that have collateral, such as your family or car, the financial institution can potentially reclaim you to property. Defaulting towards the a secured mortgage acts as a trigger with the lender to grab new security and come up with right up to suit your unmet loans.

For many who standard into a car loan, eg, the auto would be repossessed and you will ended up selling. You could also end up being accountable for a difference from inside the worthy of in the event the the auto sells for less than your debt. Repossession together with pertains to any title money you have taken out on the vehicle for extra cash.

Mortgages also are shielded. Defaulting toward a home loan is severe, as your lender is push your away because of property foreclosure market your house to gather the borrowed funds equilibrium. Should your marketing doesn’t safety the entire amount your debt, you might still owe the real difference otherwise insufficiency, based state statutes.

On the aftermath away from COVID-19, federal rules written different forms off debt relief from CARES Act. People had been granted forbearance and property foreclosure defenses through , that have conditions particular every single state.

Signature loans

To own signature loans (without any connected guarantee), loan providers can only just damage your credit and attempt to assemble by the bringing legal action.

Federal student education loans, such as, are supplied with the trust by yourself. For individuals who standard, your own financial normally find option through-other federal departments by the withholding income tax refunds, garnishing earnings, or reducing Societal Cover money.

According to the CARES Work, federal figuratively speaking ran towards automated forbearance, no attract accrual. Range issues try paused owing to .

Handmade cards plus end up in the class of consumer debt. Defaulting toward a charge card loan certainly will connect with your borrowing from the bank overall. It is possible to expect large charges, highest interest rates, and you can phone calls off collection agencies in an attempt to collect just what your debt.

How to prevent Defaulting for the a loan

- Speak to your financial: If you find yourself struggling to create costs, taking a proactive stance to work out a remedy reveals good believe as a borrower.

- File what you: If you’re able to work-out a plan, end up being vigilant during the recording every correspondence while having preparations in writing. Cautious details could help make clear potential conflicts later on.

- Make use of student loan recovery choices: Government figuratively speaking go into default immediately following 270 days of skipped costs. That is a lot of time to explore personal micro loans Memphis deferment, forbearance, income-dependent money, or other payment alternatives.

- Personalize their mortgage: Rather than defaulting on your home loan, seek an effective way to lower your monthly premiums thanks to mortgage loan modification otherwise refinancing. There are even several bodies programs made to assist property owners for the dilemmas.

- Speak to a credit therapist otherwise financial elite group: A licensed borrowing counselor helps you glance at debt standing and set up a personal debt administration package.

Inside contribution, going into default on your loans shall be avoided whatsoever will cost you. Yet not, discover numerous ways to stay in a great standing with your bank, that assist can be found. With a bit of get better thinking, you could prevent mortgage default and its unpleasant effects.