House equity funds can be a relatively inexpensive treatment for funds big-pass systems instance a house remodel, debt consolidation reduction, otherwise college education. However, like with most kinds of funds, you will find can cost you to take on. Of several home guarantee funds have additional costs that build the loan a bit more expensive than you may anticipate regarding the interest rate alone. Listed below are some of the very most conventional ones-and you can you skill on the subject.

Key Takeaways

- Domestic collateral fund make use of your family just like the collateral, so they really is actually much safer on the bank (and less costly for your requirements) than just unsecured unsecured loans or credit cards.

- Including appeal, home security lenders generally speaking charges costs, that will drastically raise your overall credit costs.

- Particular lenders commonly waive or remove certain charges attain your own company.

- In case your bank proposes to roll their charges into the financing amount, it is possible to still need to pay them-along with appeal.

What is actually a house Equity Financing?

A house collateral loan was financing that’s secured by the the new equity you’ve got gathered on the top home. Your own collateral hinges on deducting the quantity you will still are obligated to pay on your own financial from the current market worth of your home. Since you create mortgage repayments, your build equity from the whittling down the harmony your debt. In case the domestic increases into the really worth, one to increases your own guarantee as well.

That have a house guarantee financing, you receive a lump sum of cash regarding lender you to then you definitely pay back more than a concurred-on time frame, usually five to help you 30 years. The newest extended the newest fees name, the more attract you’ll pay in total. Household equity money are apt to have fixed, unlike changeable, interest levels.

Since home security finance are covered by the family, they tend getting rather straight down interest rates than just unsecured debts, including handmade cards or personal loans.

But attract isn’t most of the you’ll pay. You will face a variety of charge, if or not you only pay all of them upfront otherwise they are folded toward loan and you also pay them throughout the years.

If for example the financial can not or would not waive every charge, just be sure to discuss a lower interest alternatively. Loan providers are apt to have particular flexibility in a choice of identity length, interest, or costs.

Preferred Fees and you will Closing costs

- Assessment fees: The lender brings during the a specialist appraiser in order to check their home and guess their market worth. The house you bought some time ago may be worth a great deal more today, boosting your readily available security. A home appraisal will generally costs any where from $300 so you can $five-hundred.

- Credit report costs: The lending company commonly examine your credit history from a single or higher of your own significant credit reporting agencies observe the manner in which you have fun with borrowing as well as how reliable you are in using their expense. Loan providers will even look at the credit rating ahead of they thought providing you a house security mortgage. While you is remove your credit reports for free immediately after a good year, loan providers fundamentally charge from around $ten in order to $100 for each and every declaration when you make an application for that loan.

- File thinking fees: Such safety assorted documents and certainly will start from lender to bank.

- Label look charge: A title browse confirms that you will be the fresh courtroom manager off the house and tells the financial institution whether discover any liens on it. Charge range from $100 in order to $250.

- Application or origination fees: This is basically the percentage the lender charge to start the mortgage procedure. Particular lenders never charges one to after all; anyone else replenish so you loan places Bakerhill can $500.

- Early benefits fees: Talking about apparently strange to own domestic collateral money, nevertheless they do exists. Early payoff fees otherwise charges try an additional fees for purchasing the loan of till the stop of your own planned name. He or she is more common that have family collateral personal lines of credit (HELOCs), but really worth asking regarding the, and in case.

It’s best to check on your credit file the mistakes you to definitely mirror negatively you before applying for good family equity mortgage. You can consult all of them complimentary within formal site AnnualCreditReport.

Commonly Lenders Waive Fees?

Of a lot domestic equity lenders encourage that they do not charge financial charge. This could signify it waive the applying otherwise origination payment. They could together with ingest some costs that simply cannot be waived, for example appraisals otherwise identity hunt.

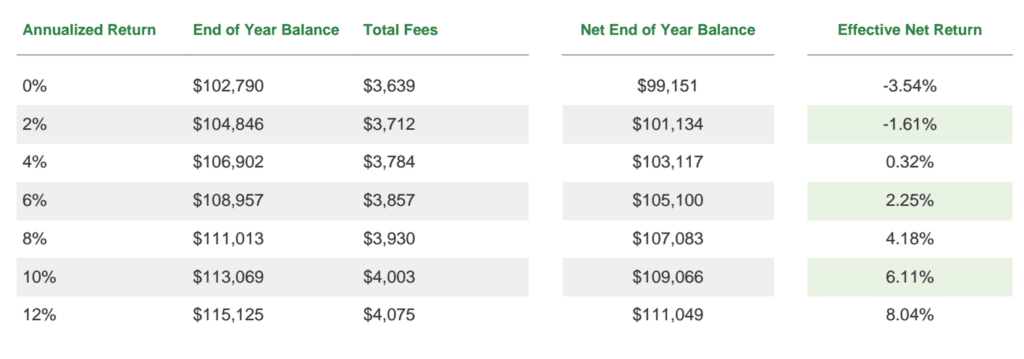

Certain loan providers might offer to move one charge into the total level of the loan. While this will save you into out-of-pocket will set you back at closing day, it is possible to nevertheless find yourself using those charges-plus appeal on it-over the lifetime of the loan.

Can be Their Lender Use the Assessment From the New Mortgage Application?

Regrettably, even although you purchased your house recently, the lending company requires another type of appraisal of a few type. Because the equity can transform when the housing market goes up or drops, the collateral elizabeth because it happened to be some time ago.

Exactly how much Security Do you want to Make an application for a house Guarantee Mortgage?

Really loan providers require you to provides at least 15% equity of your home in advance of you are qualified to receive a home guarantee mortgage.

Do you need Good credit getting a home Equity Loan?

Yes. Loan providers choose individuals which have at the very least good credit. Specific lenders put the minimum at 620, 660, otherwise 680. A higher credit score may make your entitled to a lower life expectancy interest rate in your loan.

The conclusion

House equity finance is actually a cheap means to fix borrow, however they are not versus can cost you. Consumers must ensure it discover complete revelation of all the fees, and additionally whenever and how they should be paid back. Talking with numerous lenders-and you may therefore it is clear that you are doing your research-can also cause them to become contend to provide a lesser interest rate and you will/or all the way down fees.