Domestic Collateral Loans

Its an alternative if you want the bucks having a one-big date bills, particularly a marriage otherwise a cooking area repair. This type of money usually offer fixed rates, which means you know exactly what your monthly installments might possibly be whenever you are taking one to out. Discover Second Mortgages right here.

You can expect a predetermined rates option into all of our second mortgages with an optimum identity out of fifteen (15) age. Several advantages at the job around on the financing:

- Lowest closure rates

- Zero pre-commission punishment

- Chose servicing (excludes 29 season repaired)

- Sort of percentage options

- Cash-away refinances on specific home loan plans

An effective HELOC Was…

An excellent HELOC try a personal line of credit you to definitely spins similar to credit cards and certainly will be studied to have high costs, unexpected costs, domestic renovations, debt consolidation reduction(1) or even the for example. Such as for instance a charge card, any time you repay particular otherwise all of the money put on the HELOC, your own personal line of credit is respectively replenished.

A good HELOC are a protected mortgage in this youre credit resistant to the collateral that has been made in your property. Typically, lenders will let you obtain regarding 80 so you’re able to 95 % out of your residence’s equity.

When you obtain a great HELOC, you are offered a blow months, or amount of time when your line of credit tend to stand unlock. Draw moments usually average 10 years. Following the mark months is over, your enter into the brand new installment period, and therefore to have accredited players, you can expect an excellent price which have a maximum title out-of fifteen (15) many years.

A beneficial HELOC Functions…

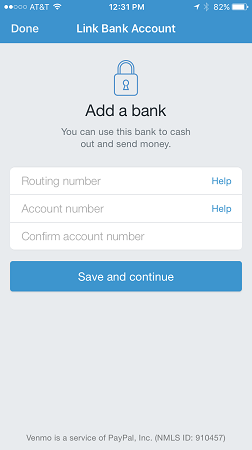

Consumers can put on to have HELOCs through AGCU’s Home loan Heart. The lender commonly assess the borrower’s home LTV (loan-to-value) proportion, and their money, credit rating or other obligations. Such as for instance home financing, HELOCs loan places Westover immediately after recognized become closing costs. A home loan and you can HELOC document number can be obtained right here.

HELOCs routinely have an adjustable price and therefore, during the higher part, depends towards newest finest speed. This means that when rates rise as they were lately the rate on a beneficial HELOC often go up properly. But, the rate into the a great HELOC is often below credit card rates.

As the HELOC might have been approved, brand new debtor begins the fresh new draw several months. During this period, any money lent regarding personal line of credit try paid back each day by-interest-simply money, which could imply a diminished payment. In the event that draw months is more than, this new borrower moves towards the payment several months, when date new payment begins to were dominant in addition to focus when it comes down to currency borrowed, definition the latest payment per month will get increase.

The newest Levels of HELOCs

Most domestic equity credit lines has one or two stages. Basic, a blow months, have a tendency to a decade, where you can access the offered borrowing as you prefer. Generally, HELOC contracts simply need short, interest-simply payments during the mark period, though you might have the option to pay a lot more while having they wade on the the primary.

After the draw months closes, you could potentially possibly request an expansion. If you don’t, the mortgage gets in the latest payment stage. From here on the away, you can don’t access additional funds, and you also make typical prominent-plus-notice payments through to the balance disappears. Really lenders has actually a good 20-year repayment months after good ten-season draw several months. From inside the installment months, you ought to pay all of the currency you have borrowed, also notice at a contracted speed. Particular loan providers may offer consumers different kinds of repayment choices for the fresh new installment months.

AGCU Financial Heart

All of the borrower differs, and we give different issues to meet your requirements. We result in the home loan techniques easy and simple by providing brand new latest inside the monetary equipment that enable you to create sound financial choices. Whatever your own home lending needs is, AGCU has arrived to navigate the method. Call our team away from financial benefits during the 866-508-2428(AGCU) or email address you for more information.