- Build money punctually

Even if you possess late repayments on your own credit reports, these become less very important the newest more mature he could be. Make sure, ergo, you spend the expense punctually in the years ahead. Some bills become more extremely important than the others and can keeps an excellent large influence on your credit score. This type of costs is your residence mobile, cellular otherwise broadband expenses and you may any other thing that has a card arrangement linked to they.

- Decrease your existing personal debt

The lower the debt account, a lot more likely you are to-be approved by loan providers of bad credit mortgages, even although you could only slow down the level of financial obligation because of the lower amounts. Evaluate if you could have the ability to build more this new minimum costs on handmade cards in which you hold an equilibrium, or if you will pay out of finance early (provided that you don’t have to spend any early installment charges).

- Avoid obtaining mortgages and other money

More programs you make, new bad it seems in order to lenders as they find it as the an indication you’re not in charge of your finances. For those who make an application for a card building charge card, such, and are refused, don’t immediately get a different card but wait a couple months before making a new software. An equivalent procedure goes for mortgages – if you are rejected, usually do not instantly re-apply when you are browsing get this app rejected as well. If you’d like to see if you may possibly feel accepted, simply complete softer queries since these wouldn’t show up on your own credit history.

The first thing we’re going to would after you meet with united states is actually over an affordability review, anything all the potential resident needs to manage following the introduction of Regulators legislation a short while ago. Before this, lenders basically acknowledged someone’s home loan software established its money. Today, they want to examine how much cash capable realistically afford to blow back, definition taking a home loan would be fairly easy in the event the you could potentially reveal that you possibly can make their home loan repayments. A cost review takes into account:

- Your credit history and you may credit rating

- Their a job status and you can level of income

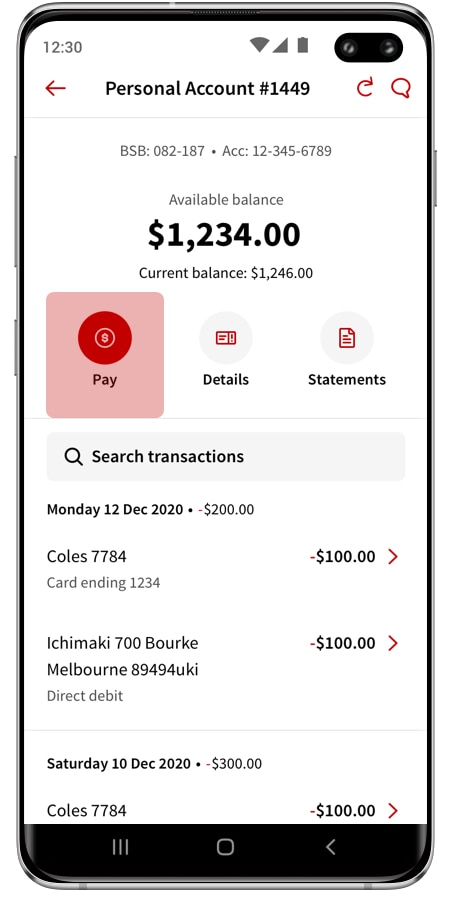

- What kind of cash you have on your account, in addition to whether or not there have been people unusual deposits otherwise outgoings

- Their number of personal debt

- How much you really have into the offers of course, if it will save you continuously

- If you hold an enthusiastic overdraft otherwise alive in your function

- The manner in which you invest your finances also rent, child care, memberships and you can vacations

Whether you are applying for fundamental mortgages or less than perfect credit mortgage loans, lenders takes many of these points into consideration. A large financial company does so it prior to people application with the intention that any potential factors might be understood and treated.

Is also a broker help me to get a home loan which have less than perfect credit?

Bringing home financing are challenging, specifically if you features less than perfect credit and you will feel unpleasant regarding the dealing with lenders and receiving kicked back.

The place you has actually present obligations check how you can treat which before applying to possess bad credit mortgage loans

We make the job of obtaining to search and you will evaluate plenty of loan providers from you, and provide your to your ideal selection, according to research by the information provide united states.

We know the marketplace, in addition to hence lenders render bad credit mortgage loans, loans in Florissant and you will the required steps to really get your app recognized. It’s important one to a home loan software is manufactured in the proper way, that have logic one to a loan provider encourage and you will cause to spell it out this new adverse borrowing from the bank.

You merely get one possible opportunity to apply, so make sure that you might be writing on an agent you never know exactly what these include creating.