As home loan rates drop, people would be tempted to comparison shop to have a much better contract. Or perhaps he has come into some cash and want to repay their fixed-price financing early.

But potential notice offers could well be counterbalance because of the a much bigger upfront cost: An effective prepayment costs, referred to as a rest payment.

All of the finance companies obtain on general market to loans lenders. A break percentage discusses the expenses obtain from the bank whenever a consumer finishes a binding agreement early.

It is not easy to learn beforehand how much cash these costs will definitely cost, because they depend on latest wholesale rates, among other things.

As to the reasons today?

Usually, break charge just getting an issue when interest rates is actually shedding, said Christopher Walsh, the new inventor off monetary degree providers, MoneyHub.

“Possibly last year, whenever rates left broadening, it chosen an effective five-season deal. Now, they see mass media stores reporting interest rates is losing. For the same device, they think these are generally using too-much.”

In recent months, big financial institutions was indeed reducing home interest levels. It adopted falls within the wholesale cost, considering expectations one main financial institutions are getting nearer to reducing their benchmark prices.

Costs dropped once again after February, adopting the Put aside Bank revealed it actually was staying the state Bucks Price at 5.5 percent. And you may once more, on the Friday, to possess ASB and Kiwibank.

Background

This new OCR hit an extended-term reasonable of 0.25 % in the . Nevertheless mediocre home loan rates didn’t base aside up until in the eighteen months after.

As to the reasons? This new OCR impacts the cost of credit to possess loan providers. Increasing it lowers discretionary paying, cooling new economy. Minimizing it generates it cheaper in order to borrow money, promoting purchasing. Generally speaking, in the event the OCR increases, mortgage loans carry out, also – and you may the other way around.

Returning to : An average home-based home loan rate of interest having https://cashadvancecompass.com/loans/tax-refund/ a two-year contract was 4.twenty two %. A year later, it had been 3.47 per cent. Inside 2022, it actually was 5.04 %. And you may this past year, 7.03 per cent. In the March this current year, it was 7.45 percent.

Into the Tuesday, Kiwibank revealed having family consumers that have at the least 20% guarantee, the brand new bank’s a couple of-season label was six.79 %, and six.89 % of these with faster collateral. ASB’s two-12 months price together with fell so you can 6.79 percent.

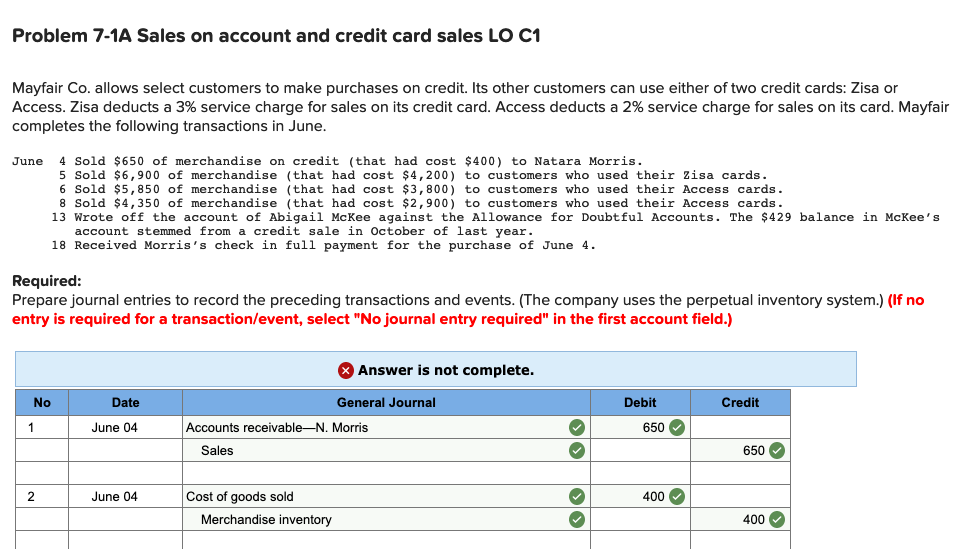

Figuring break charges

Your own price will tell you have to pay a break fee for those who stop it very early, however you will maybe not understand accurate number ahead of time, Walsh told you.

If you find yourself split fees can appear unjust, you can find regulations positioned to be certain financial institutions is actually coating its can cost you and never taking advantage of them.

The credit Deals and you can Individual Money Work states prepayment costs is actually unreasonable only when they surpass “a fair imagine of the creditor’s losses due to the fresh new region otherwise full prepayment”. An optional algorithm is offered because of the Borrowing from the bank Deals and you may User Finance Legislation.

However some banking institutions, such as for instance Kiwibank, use their particular algorithm so you can calculate charges: “I implement our own statistical algorithm to help you estimate your own fixed rate break pricing, and that i think most readily useful shows a good guess of your losings throughout these things.”

ANZ’s head out of homeowners Emily Mendes Ribeiro said people increases normal costs toward their house mortgage from the to $250 a week. In addition to, yearly capable make an additional lump sum payment payment upwards to 5 percent of its newest loan amount.

Rates derive from the interest rate words, how far owing to individuals are, and you can – primarily – this new general fixed rates count, she said.

Fixed lenders are apt to have lower rates than simply floating or flexible of them, however, many borrowers has actually a split financial – a mixture of both interest rates. Zero break charge apply at drifting mortgage brokers.

Extenuating activities

“[The lending company] might possibly be losing money most of the time once they waived they. Finance companies will realize their deals and you will small print, very I’d end up being really astonished whenever they waived a healing off loss for anybody.”

Sometimes, finance companies will give dollars contributions to draw clients, to greatly help counterbalance very early installment costs. But these wide variety features refuted through the years.

Complaints

“Customers are seem to surprised at the dimensions of the fresh costs they face throughout the duration of changing interest levels,” deputy banking Ombudsman, Sarah Brooks told you. “One amaze prospects them to grumble so you can you.”

Immediately after brand new Set-aside Bank’s raised new OCR regarding 0.twenty five so you can 0.5 for the , “i received a little increase away from cases regarding the domestic financing break will set you back, specifically dollars sum claw backs”, she said.