Credit ratings was crucial from inside the creating your borrowing from the bank travels and generally determine their qualifications for different lending products such as for instance signature loans and you may credit cards. A 650 credit history falls under the class from fair credit ratings although it score is not classified since the bad because of the FICO criteria, it can come with certain possibilities.

As of ericans had a credit rating less than 650. If you find yourself a 650 rating isn’t really perfect, it’s far regarding a dead avoid. In this article, we are going to discuss various version of funds offered to those with a fair credit rating.

Do i need to Rating that loan That have a 650 Credit score?

Yes, you could. A credit history off 650, classified just like the fair credit, opens up the doorway to various financial products, and additionally mortgage loans and you can automobile financing. not, it’s imperative to keep in mind that having it credit history often means you are able to face large interest levels as opposed to those with more sturdy credit pages.

For-instance, a get out of 690, that’s considered good credit, generally secures alot more advantageous mortgage terms. Despite this, particular financing bypass the need for borrowing from the bank checks, probably offering most readily useful terminology for even those with a 650 credit score.

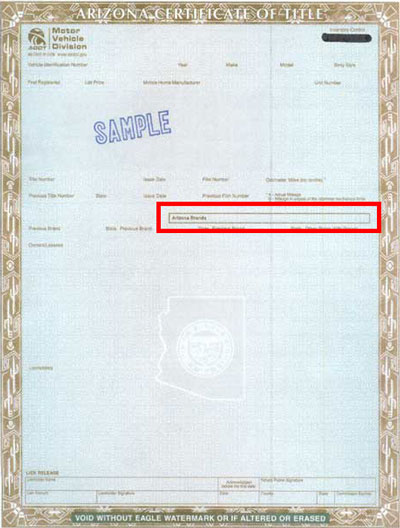

Do you really Get an auto loan With an excellent 650 Credit rating?

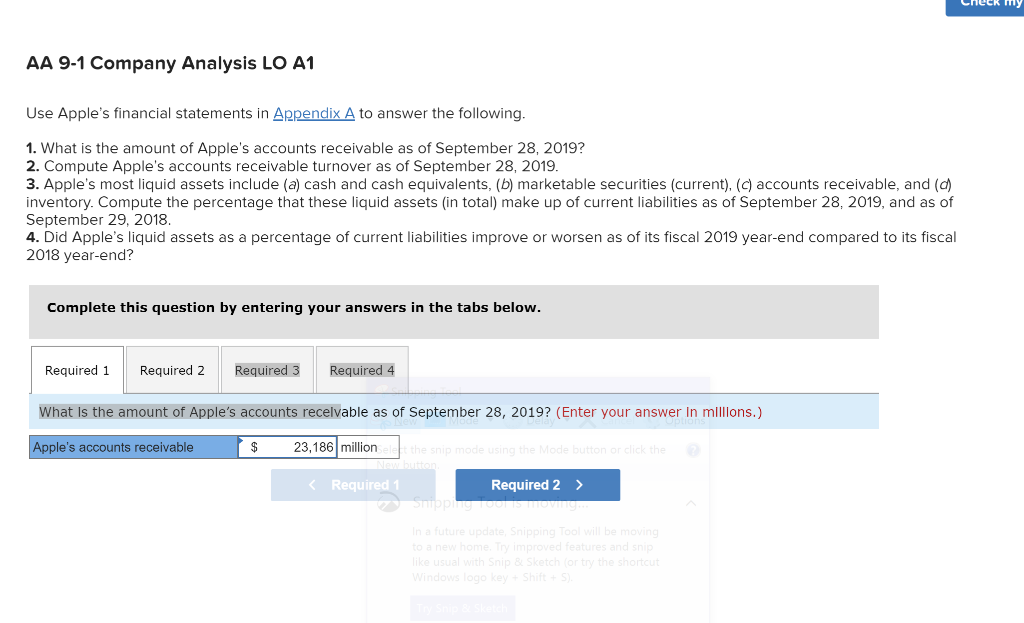

Sure, getting an auto loan with a good 650 credit rating is possible, but be ready for highest interest levels. So you can teach, for the , consumers which have best borrowing (FICO get away from 720 or more) obtained the average Annual percentage rate of 5.34% to your the 60-month automotive loans.

Meanwhile, those who work in the 620-659 credit rating range confronted the average Apr regarding %. Rates go even higher having results anywhere between 590-619, loans in Holly averaging %. It is required to keep in mind that interest levels can vary generally certainly loan providers, even for those with similar results.

Particularly for subprime borrowing from the bank levels, looking around is a must. The new FICO model prompts speed looking, offered multiple inquiries of the same loan style of contained in this a primary period while the a single query for rating intentions.

Must i Rating home financing or Financial Having a beneficial 650 Credit rating?

Indeed, a great 650 credit rating is also qualify your for a home loan, with many different possibilities. That have a get regarding 580 otherwise significantly more than, you will be entitled to an FHA mortgage, requiring simply an effective step 3.5% downpayment.

Getting a conventional home loan, minimal credit history is 620 depending on Fannie Mae’s requirements. However, lower ratings tend to entail higher conditions, particularly an optimum thirty-six% debt-to-money ratio and you can a twenty five% deposit to own a 620 score.

While it’s you can to acquire a conventional financing with because the reasonable because the 5% down, or even step three% sometimes, it typically need a minimum rating out of 660.

Ought i Score Personal loans That have an effective 650 Credit score?

While you might not availableness an educated pricing, a great 650 FICO get could be adequate to qualify for reasonable credit personal loans. It is very important remember that credit score is certainly one foundation in the loan acceptance. Lenders think about your revenue and you will complete obligations profile.

Without common with an unsecured loan often a credit file otherwise credit score may be needed discover a consumer loan.

Actually candidates with high credit ratings can be face getting rejected if the its established obligations is viewed as way too much. In addition, hard credit inspections can get impact your current credit history negatively and you will credit history enjoys the will cost you.

Just what Financing Features Reduced Credit score Requirements?

Payday loan was recognized due to their minimal credit criteria, which makes them a viable selection for small financial help. These include brief-name loans, and as such, they often do not include borrowing from the bank checks, or at the most, a mellow credit score assessment is completed.