When you take aside a vintage home loan the original payment your create to help you a lender pays primarily attract then later on money begin repaying prominent.

- mortgage

- interest

- principal

- amortization

- discounting

7 Answers seven

This means that, math. All other answers are higher, but I thought I might include things tangible so you’re able to describe a little.

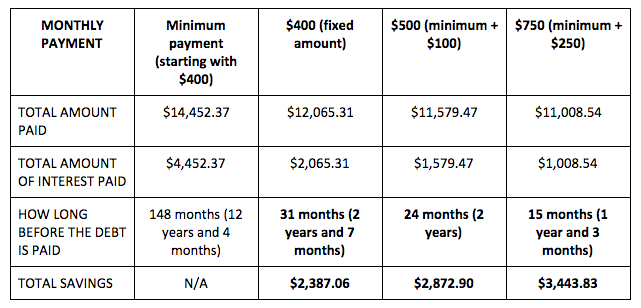

Believe a beneficial counterexample. Imagine I use $120000 at the 1%/week desire (I am aware mortgage loans are usually valued with annual costs, but this will make the latest mathematics simpler). Next suppose I want to pay a fixed amount of principal per month, in the place of a fixed payment. Let’s say you want to pay off the mortgage from inside the ten many years (120 weeks), so we enjoys a predetermined prominent percentage away from $1000/times.

Therefore what’s the attention getting few days step one? One percent out-of $120K is actually $1200, so your complete payment might possibly be $2200. The next times, the attention was into $119K, so your payment might be $2190. And stuff like that, through to the last month you are paying $1010. Very, the degree of notice you only pay monthly declines, because the really does your payment per month.

But for we, paying large money at the beginning and you can less ones towards the the brand new end is very backwards, since the majority folks earn more as we progress within our professions. 16 years after i got away a mortgage having an excellent $1300/week commission, I have found they fairly easy to invest, though it is actually a little while difficult to our very own cash flow initial. Continue reading “So why do finance companies would like you to pay off attention in advance of prominent?”