For those who’re also trying to find a safe percentage means for mistake-totally free put and you may withdrawal, this is just the right choice for your! MuchBetter uses large-top encoding to guard your data and make certain one hackers otherwise crooks don’t access your own personal information. Continue reading “MuchBetter Gambling enterprises United kingdom 2024 Greatest Local casino Internet sites One Accept MuchBetter Dumps”

Categoria: Tutti

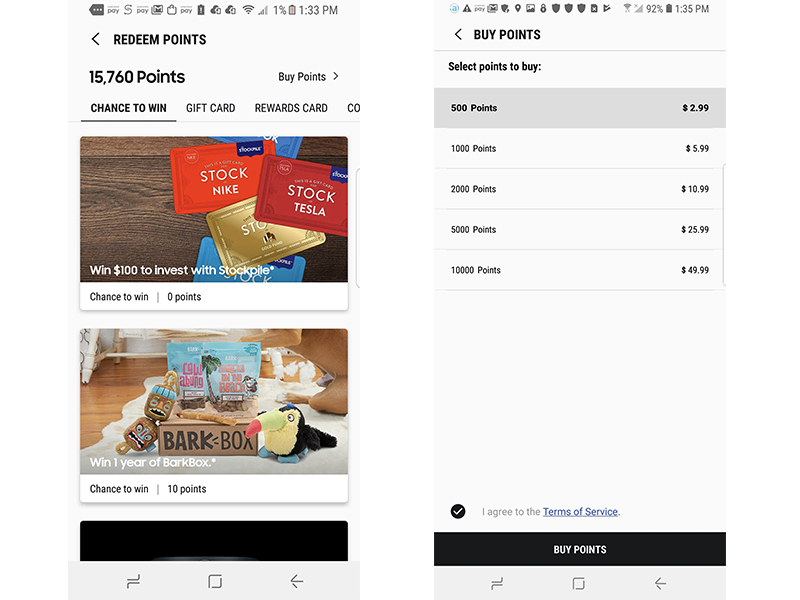

Greatest 20 Muchbetter Online casinos 2024

Articles

The application form is quite affiliate-amicable and has an intuitive user interface. Having fun with MuchBetter is easy, for even people who find themselves shorter used to electronic fee possibilities. Last but not least, the best MuchBetter Gambling enterprises has loyalty apps, VIP Nightclubs, and you will regular advertisements. The newest multi-tiered techniques also have private bonuses, 100 percent free cash, and you can 100 percent free revolves no betting. Continue reading “Greatest 20 Muchbetter Online casinos 2024”

Better Skrill Casinos in america to have 2024

Articles

At the same time, it will offer a supplementary condition-of-the-art ability to advance safe their digital membership. Continue reading “Better Skrill Casinos in america to have 2024”

Contrast a knowledgeable Skrill Casinos in britain 2024

Blogs

Other concern is your eWallet might be at the mercy of exchange fees and you can rate of exchange. no deposit cash Winorama Introducing our very own guide on the Web based casinos you to definitely take on American Show. If you are searching to compliment your own betting experience, knowledge fee tips is vital. Continue reading “Contrast a knowledgeable Skrill Casinos in britain 2024”

Strategic Standard: In the event that you Leave From your own home?

That have a proper standard, you determine to allow your domestic experience a foreclosures due to the fact it’s an adverse monetary decision to store they. Learn the consequences and you may solutions.

Whether your domestic has been an adverse investment, you are considering defaulting on the mortgage repayments, even although you can always manage to make certain they are, and letting a foreclosures occurs. Continue reading “Strategic Standard: In the event that you Leave From your own home?”

It is tautological when there aren’t any loans about reserve, a good repurchase out-of defaulted funds don’t exists

Environmentally friendly Tree after that repurchases the loan out-of Cover 90 days once they repossesses the latest equity

Set-aside REPURCHASE. In the event a default happens in terms of one Offer kept from the Consumer, hence standard requires that the fresh secure assets end up being repossessed, Buyer shall either (1) toward Seller-Servicer abreast of consult the modern documents necessary for the beginning out of an excellent repossession continuing regarding term of Buyer otherwise, (2) reassign every brand new data files to help you Provider-Servicer whom, therefore, usually commence repossession process within its individual term. In both such as for example, Seller-Servicer shall shell out Visitors 3 months pursuing the repossession of the secure assets might have been finished. New repurchase are going to be from set aside finance oriented regarding every person customer duty purchased from the Merchant-Servicer as the set forth in Section cuatro(e) here. Upon the repurchase from the set-aside financing of any particular customer responsibility, the set aside funds would be charged toward following kept get rates advanced by the Visitors and Consumer’s portion of the fund charge calculated at this point of repurchase, pursuant on the terms of the first Offer, and all of records, together with Identity, are allotted to Merchant-Servicer. Seller-Servicer agrees through to after that selling of the repossessed equity, to put the web based proceeds of your sale, immediately after subtracting all the costs, from the set-aside fund or if perhaps the fresh income occurs in 90-date period, the web losings, or no, toward transaction might be billed with the set-aside finance. (Stress additional)

SoFi has the benefit of certain book has with respect to refinancing college loans

Eg, for many who eliminate your task they are going to stop the monthly payments and help you find another work. Nonetheless they give community help like interviews instruction, resume feedback and you may discussing projects. This is naturally yet another function you simply will not get in good more traditional surroundings.

SoFi has the benefit of financing specifically for people that happen to be looking to go after and you will MBA. New fixed rates for those money currently stay within 5.95% and varying pricing start in the cuatro.84% Annual percentage rate. Nevertheless they promote deferment and you may interest simply installment choice during school.

Mortgage loans and you may Refinancing mortgage

Among the many newer products regarding SoFi is their mortgage loans. Continue reading “SoFi has the benefit of certain book has with respect to refinancing college loans”

By area one of the Work away from Sep 21, 1950 (Club

(I) a benefit connection discussed this kind of subparagraph doesn’t always have the home business office regarding the State of your bank carrying providers financial part, and you may

(II) like organization cannot qualify just like the a domestic building and you can financing connection below area 7701(a)(19) of your Internal Funds Password away from 1986, or will not meet the investment constitution test imposed of the subparagraph (C) of this point toward organizations trying to thus so you can be considered, such https://cashadvanceamerica.net/personal-loans-mi/ as for instance deals relationship can be susceptible to new criteria upon which a bank can get hold, efforts, and you will introduce branches regarding the County where in fact the offers association can be found. Continue reading “By area one of the Work away from Sep 21, 1950 (Club”

Mortgage restrict goes up more than $step 1.1M given that home prices surge

Homeowners are experiencing growing down payments

The new Government Construction Finance Agency’s (FHFA) the newest conforming financing limits to own 2024 indicate homeowners can score larger mortgages supported by Fannie mae and you may Freddie Mac computer.

The fresh new financial restrict for conventional financing backed by Fannie and Freddie could well be $766,550, an increase of $40,350 out of 2023. When you look at the high-costs places that 115% of your regional median household worthy of try bigger than $766,550, homeowners is permitted to make use of the high-pricing area financing maximum, that’s 150% away from normal mortgage constraints. You to forces the maximum for highest-prices areas to help you $1,149,825.

The choice comes after brand new great obtain in home rates across the U.S., whilst home loan costs enhanced. Home values rose 5.5% amongst the 3rd one-fourth out of 2022 and also the third one-fourth regarding 2023 and had been upwards 2.1% than the next one-fourth regarding 2023, according to the FHFA Domestic Speed List.

“The latest loan limits essentially indicate that home owners who possess seen rate appreciation can refi into a good Fannie or Freddie mortgage,” Charles Williams, founder and you will President of a property and you can financial behavioral studies merchant Percy. “Essentially, with the restriction increased in order to $766,550 regarding $726,two hundred, the new FHFA is actually staying the financing guidance inside lockstep having house rate prefer. Continue reading “Mortgage restrict goes up more than $step 1.1M given that home prices surge”