- A credit history of at least 640

- Constant, recorded source of income

- Enough earnings to cover their existing bills additionally the suggested house financing percentage

- Individuals need certainly to plan to are now living in the home as his or her head residence

- Individuals have to purchase an adhere-situated family. Cellular homes and apartments usually are not approved

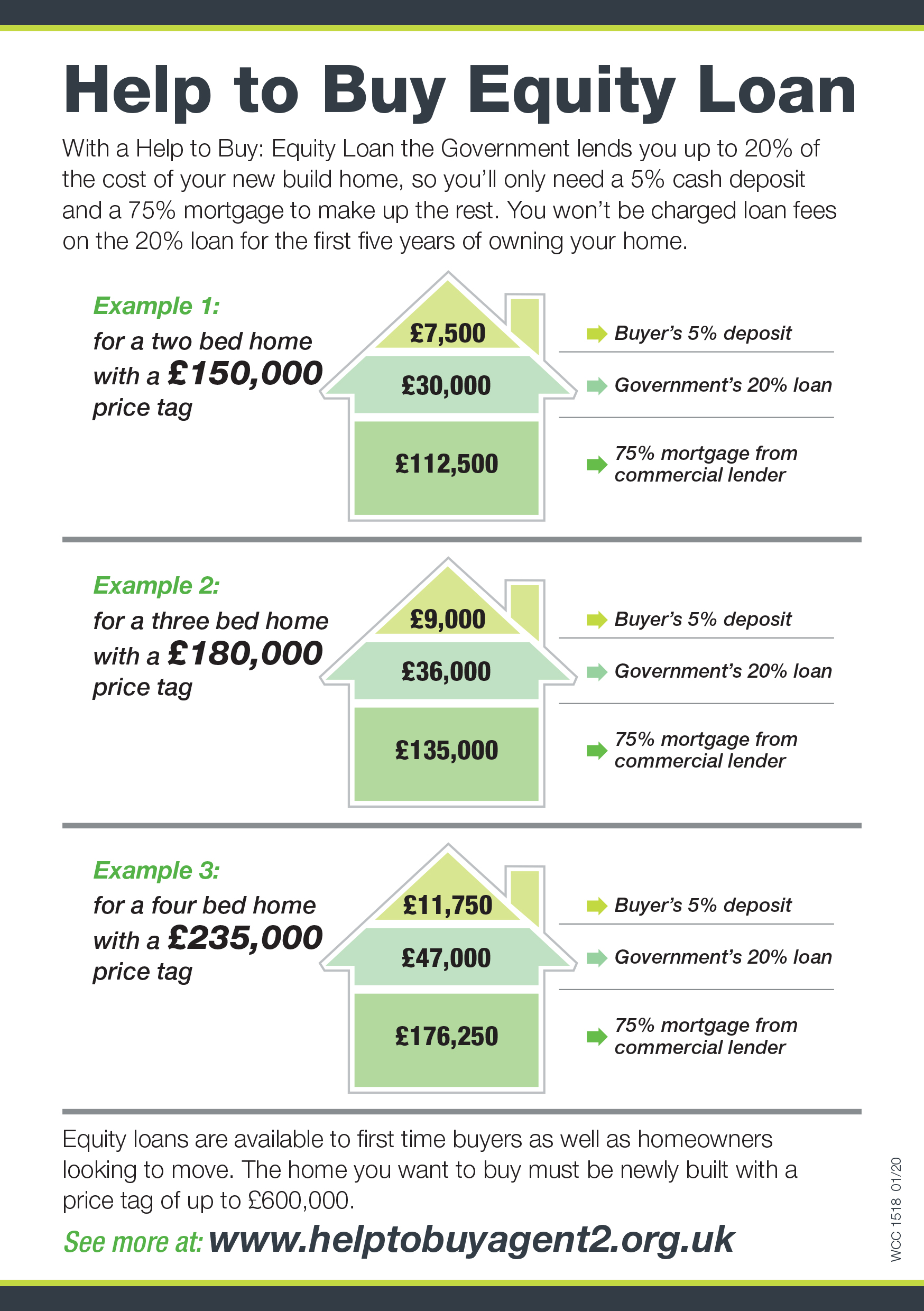

WHEDA even offers caused it to be possible for individuals qualify for property get today rather than hold off a few years in the purchase to save cash towards down payment and you can closing costs.

The easy Close Advantage can be acquired to the people you to definitely be eligible for new WHEDA Advantage system. The simple-Close allows borrowers locate a 2 nd loan that may help with the fresh settlement costs therefore the called for off fee.

The easy-Romantic mortgage is also a fixed-speed mortgage since WHEDA mortgage loans. not, so it dos nd financing is just to own ten years. Borrowers that qualify for the brand new WHEDA Advantage financing tend to automatically apply with the Easy Romantic financing. Similar assistance to own credit and you can earnings often affect both nd mortgage because step 1 st financial.

The easy-Intimate loan is just made to assistance with advance payment fund and you will settlement costs. This is simply not designed for while making fixes otherwise developments to your implied possessions.

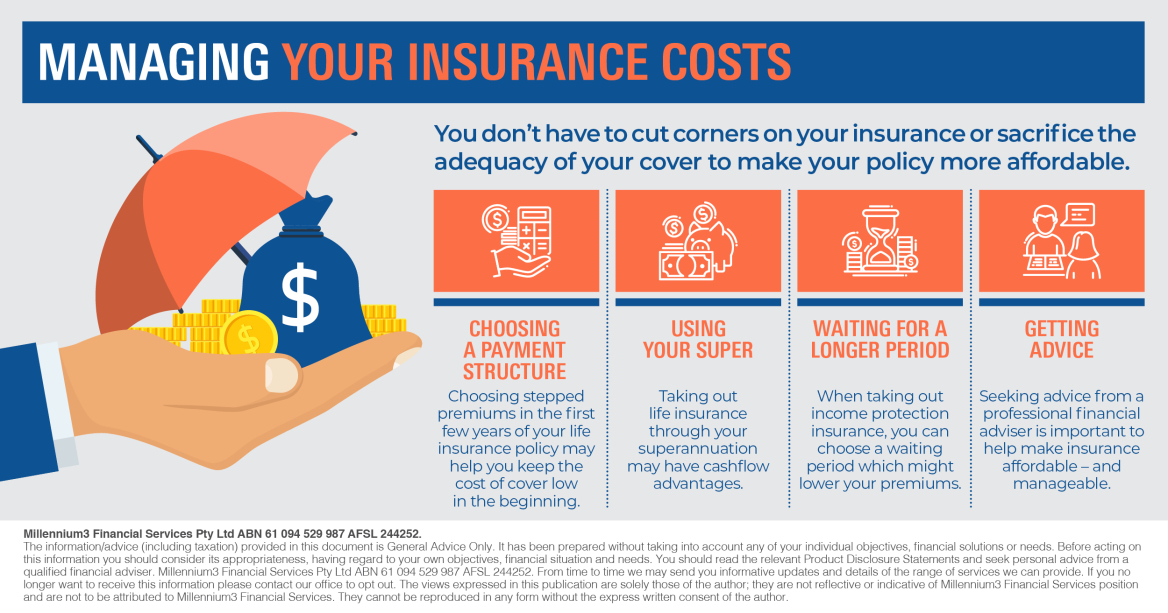

WHEDA Helps you save Money on Your Federal Taxation

Using government income taxes is one thing that every professional deal with. WHEDA features a tax coupons benefit to let residents conserve more of the difficult-acquired currency.

Whenever you are accepted having a WHEDA mortgage, then you can be also allowed to utilize the WHEDA income tax advantage. The fresh tax borrowing from the bank enables you to rating a cards in your annual taxation go back. An income tax credit is superior to an effective deduction. Continue reading “Delivering Help with the brand new Closing costs and Advance payment”