Ny, – The newest casing cost drama-with a high rates of interest, large property cost, and you can lowest have-could have been well documented. To simply help homebuyers target such pressures, Chase Domestic Credit means getting financial resources and you will homebuyer training, and additionally expanding their Closing Be certain that out-of $5,000 so you can $20,000.

Latest ics has actually impacted the newest value of homeownership for many Us citizens, and also at once, battle only has enhanced, said Sean Grzebin, head out-of User Originations to possess Chase House Financing. We’re focused on the things we can manage in this environment that will be support the customers right domestic. Growing our very own Closing Guarantee so you can $20,000 was a representation of our own confidence obtaining consumers to the their new house without delay.

Has just, the financial institution increased that it grant of $5,000 so you’re able to $seven,500 within the fifteen places over the U

Pursue now offers low-down commission options-as low as 3%-and flexible credit assistance in order to make significantly more homeownership opportunities for more some body over the income range. Another way Pursue was enabling users carry out value is by using this new Pursue Homebuyer Offer. Which give offers to $eight,five-hundred during the qualified elements, which can be alongside state and you may local homebuyer guidance, to reduce the speed and you will/otherwise remove settlement costs and you can downpayment.

As the 2020, Pursue has furnished more than $96 billion within the Pursue Homebuyer Give financing for over 29,000 customers. When you look at the 2023, Chase plus linked homebuyers which have up to $15.8 billion into the condition and you will local homebuyer and you can deposit assistance apps. People may use Chase’s Homebuyer Guidelines Finder to analyze advice applications by which they may be eligible.

I would personally recommend consumers and work out lenders compete to suit your needs-take the time to speak with several financial and you can check along with your financial

Pursue released their give system nationwide for the 2018 having a good $2,500 give for all those to find during the reasonable-to-average money census tracts. Next for the from inside the 2021, the bank circulated an excellent $5,000 homebuyer grant inside census tracts designated once the most-Black colored, Hispanic or Latino around its Special-purpose Credit System (SPCP), according to the federal requirements of one’s Equivalent Borrowing Opportunity Work (ECOA) and you may Control B. S.:

- Atlanta, GA

- Chi town, IL

- Dallas, Colorado

- Fort Lauderdale, Florida

- Fort Really worth, Tx

- Houston, Tx

- Vegas, NV

- Los angeles, Texas payday loans Ca

- Miami, Florida

Brand new homebuying techniques should be overwhelming, regardless if you are a primary-day otherwise educated homebuyer. Pursue try assisting to instruct prospective people towards ins and you can outs of the home get techniques, homeownership and everything in anywhere between. This new JPMorgan Chase Institute has just released look getting in touch with from the strengths having users to be knowledgeable when it comes to its financial and you may financial solutions. The new Institute’s report, Undetectable Costs off Homeownership: Competition, Money, and Lender Variations in Mortgage Closing costs, reveals that closing costs are different significantly because of the sort of lender, that have banks are economical on average than nonbanks and agents.

Homeowners don’t usually read what exactly is flexible and you can just what may differ out of bank to help you financial, said Grzebin. Getting told can help save a little money in the end.

Extra resources are Chase’s Homebuyer Training Heart-a comprehensive learning cardio of these looking to buy property and have now home financing. Chase’s honor-effective podcast, Student In order to Customer happens including a few season of symptoms presenting discussions having actual customers and you may specialist website visitors discussing homebuying and you will ownership, domestic guarantee, prominent misconceptions, renovations, and you may funding characteristics.

An instant closing procedure shall be trick, especially in competitive circumstances. Brand new Chase Closing Ensure commits so you’re able to an on-go out closing from inside the when around three weeks otherwise eligible people rating $20,000. It short period of time bring is obtainable getting being qualified people to buy a great home with a good Pursue home loan until . Users need to fill out called for monetary documents and gives a fully-carried out purchase deal. Following, Pursue tend to close the mortgage with the or till the contract closure day or spend the money for visitors $20,000. Financing are often used to discount underwriting charge paid down from the home loan closure or lower the rate and you can down payment.

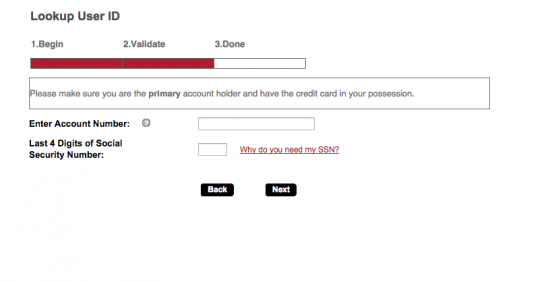

Pursue continues to promote a full suite away from electronic gadgets so you’re able to assistance buyers on the path to homeownership, in addition to Pursue MyHome. That it electronic program provides all things family, everything in one put with an enhanced assets look and also the power to comment mortgage possibilities, make an application for and you may take control of your home loan. Concurrently, Pursue also offers some digital mortgage calculators that can help buyers recognize how far they’re able to pay for.