- Relationships Financing: It is a personal bank loan secure with regards to getting proper care of relationship-associated expenditures.

- Domestic Restoration Financing: It is an unsecured loan secured for the intended purpose of remodeling your home.

- Student loan: Its a personal bank loan covered for the true purpose of delivering proper care of tuition and higher knowledge can cost you.

- Personal bank loan: It is an unsecured loan secured for the true purpose of to buy individual durables.

- Car finance: Its a personal bank loan safeguarded with regards to to buy yet another or secondhand automobile.

- Scientific Loan: It is a consumer loan shielded with regards to getting proper care of scientific issues and expenses.

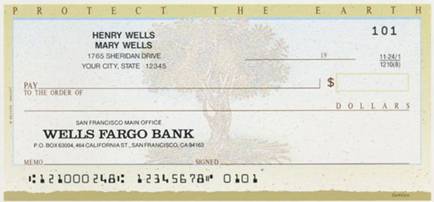

CASHe brings unsecured small-identity personal loans from ?fifteen,000 so you can ?cuatro,00,000 getting financing tenures between 90 days in order to as much as eighteen months by way of a sensible, intelligent electronic mortgage application. Its user-amicable program permits less loan applications and you will shorter mortgage disbursals. The entire process of making an application for a loan try quite simple. The consumer logs in using their Myspace, LinkedIn, or Yahoo Plus profile. The next thing includes completing very first info and you will uploading their name proof, including his Bowl cards, his latest income slip, along with his financial declaration, by using the app. Once inserted, brand new eligibility was verified within minutes, as well as the eligible amount borrowed. The fresh qualification was calculated having fun with an advanced algorithm you to definitely mines this new borrowers’ mobile and you may social network and you will demands first files to-arrive during the a social Loan Quotient SLQ get and you can a loan qualifications count. Due to the fact borrowing is approved, brand new questioned number is actually paid with the customer’s family savings within minutes. The brand new fees techniques is as easy as making an application for a loan. An individual can privately credit the amount straight back compliment of bank transfer into the designated repayment dates.

Consumer loan Interest rates –

CASHe costs processing fees ranging from ?500 to ?1,two hundred according to financing unit youre eligible for. Our very own rates of interest are competitive and you can determined for the a per-few days reason for the whole count.

You can expect a two.50% rate of interest monthly (Equal to decreasing the equilibrium interest rate to three.71% for every single EMI) for the loan amount. We provide a 5-date attention-100 % free sophistication period to blow your EMI at the end of each month. But do keep in mind that there was an excellent 0.7% interest commission punishment billed for the after that payment delays.

Techniques for Profitable Personal loan App –

- Best documentation: Posting the required paperwork is amongst the top conditions getting a successful loan application. Because system is actually 100% digitized, most of the documents are required is submitted toward software in itself. Perform mention for less handling and you may recognition and you may disbursals. The latest documents have to be genuine and legible.

- Your credit rating: Some creditors look at the bureau results to determine your credit rating just before credit your an unsecured loan, CASHe spends higher level AI-founded algorithms and you can alternative studies kits to access their credit score. The brand new scores produced of SLQ influence the creditworthiness.

- A good cost record: It is imperative to have a great repayment record on the past finance, whether or not regarding CASHe or other creditors and you may banking companies. Later money or default condition http://www.paydayloancolorado.net/briggsdale/ on the any money facing your own term will immediately flag your given that a buyers with an awful character into our very own platform.

Why does technical subscribe to deciding credit to a great borrower like you? –

Technology that enables us to send a sophisticated consumer sense was our proprietary AI-built algorithm known as Personal Financing Quotient (SLQ). SLQ uses a mix of Large Data Analytics and you can proprietary Artificial Cleverness founded algorithms to evaluate conventional enters in addition to user’s digital footprint to measure their creditworthiness. SLQ is actually submit-appearing in nature since it measures good borrower’s tendency to settle based on available today information, in place of traditional credit rating solutions, and that send a get based just toward historic monetary choices. One without records from the Indian economic climate however, whom the SLQ motor decides provides a good tendency to repay could possibly get financing out of CASHe. That is somewhat book, therefore we features successfully you certainly will carry out a huge clientele whom now enjoy credit of CASHe.