Exactly what You will see

There is no doubting the newest homebuying techniques is actually fun. Sure, it may be exhausting, therefore can make your anxious in some instances, nevertheless idea of undertaking more having a clean slate for the an alternative venue is sufficient to make anyone happy due to their coming. Picturing all brand new chairs that can complete our home and put a smile on deal with of every friend.

Perhaps a motion picture-theater-concept reclining leather-based couch or an intelligent ice box which have an effective touchscreen display exterior that is stuck your eyes. Either way, that is a great, and you may large, exchange. One which will be too large whether your loan have not closed yet ,.

Identical to to get anything towards borrowing ahead of your loan attacks the closure desk, it’s bad for your loan if you money the fresh seats in advance of doing the very last part of the loan process. Indeed, there are some some other good reason why investment chairs early try bad for the loan.

They Alter Their Borrowing from the bank

Sometimes, credit ratings is actually reverified by underwriter. In case the credit report to the file expires before closing, their lender will have to pull an alternate report. Thus, should your underwriter sees yet another debt or improvement in your credit you to definitely wasn’t truth be told there ahead of, they may hold the loan for further remark and you will fortifying.

In the mortgage processes, Mortgage Bankers are notified whenever the fresh new credit accounts are exposed. When they realize about them, they need to obtain the details of the debt and you may put it on latest obligations toward software. This might cause problems on the financial obligation-to-earnings ratio and you will, potentially, setting you’ll don’t meet the requirements.

From the Atlantic Bay, we manage what is actually called Upfront Underwriting. That means you are getting conditional approval into real money count you be eligible for before you make an offer to the a home. One customizations for the borrowing from the bank you are going to void one number.

Fresh Financial obligation Problems Your credit rating

As you you’ll assume, new debts lose your credit score. Thus, for many who covered yet another sofa together with your charge card, while have not paid off it well by the point your lender rechecks your credit rating, you could see specific negative effects on your loan bundle.

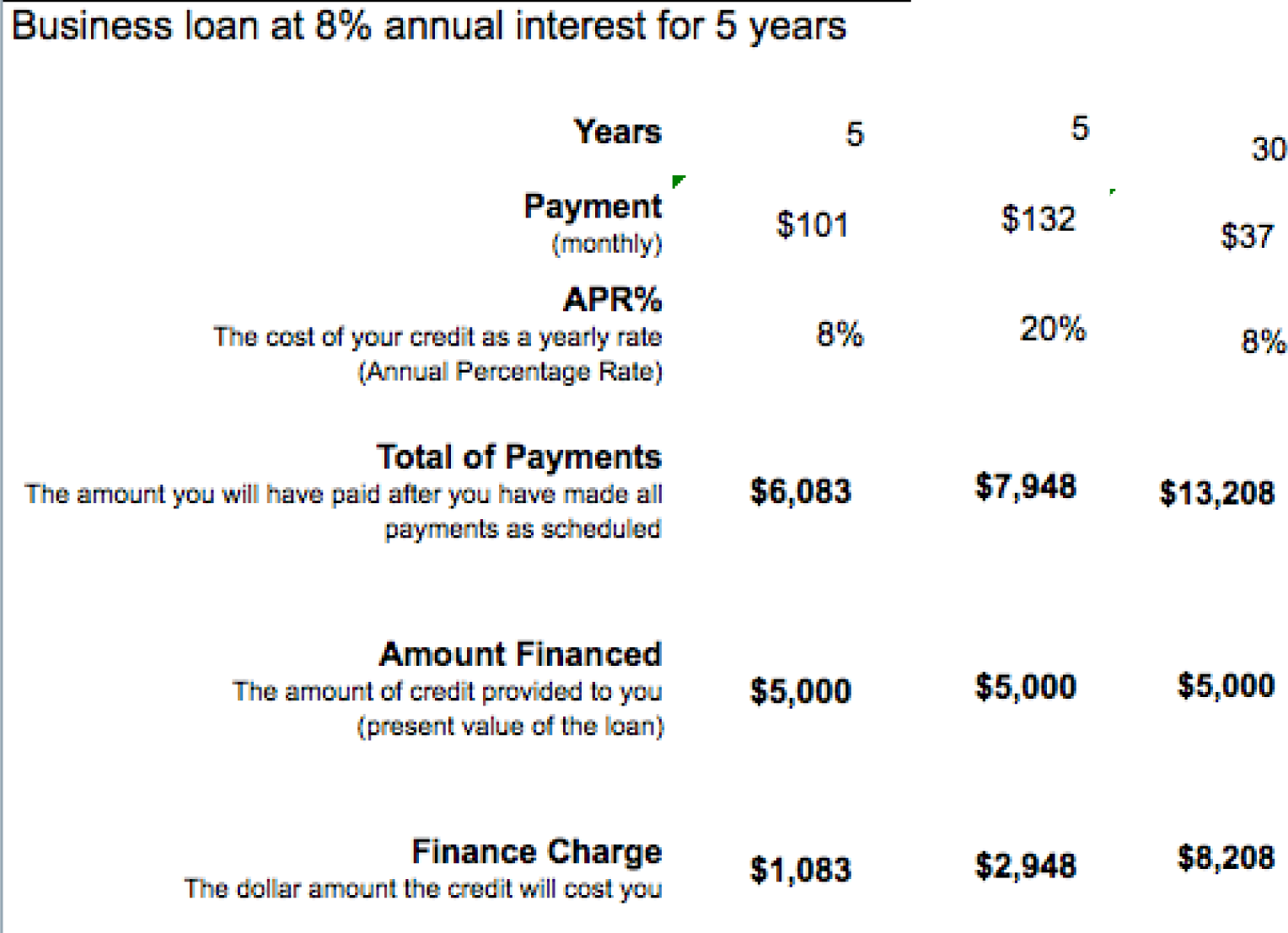

When your score could have been decreased, this may change the loan because of the raising their rate. In the event your get fell using your lender’s lowest requisite, this may cause the loan become denied.

Very loan products enjoys a card minimum, therefore if the brand new seats loans falls the score, you are in danger off dropping your loan. This means you’ll have to restart the method right from the start. Typically the most popular loan minimums are different of the financial.

Including, in the event your credit history drops less than 640 immediately following to invest in furniture, you’ll be able to not any longer qualify of the USDA loan.

Purchasing Money is Maybe not the answer

Even although you pay money for chairs prior to closure that have cash, the loan could remain at risk. Don’t forget in regards to the deals need to suit your advance payment and you will closing costs! Va and you may USDA loans try 100% funded, but most other financing models require you to pay a portion away from new down payment upfront (usually 3% to 3.5% depending on the loan). And you will closing costs, or closing costs, for your mortgage will be the charges from the financial with the attributes it given. Comprehend our very own writeup on both upfront will cost you you can even look for.

www.paydayloansalaska.net/akiak

Leave The Borrowing End up being. For the time being

To put it differently, ahead of the loan closes, cannot do anything that will improve your credit rating otherwise overall finances. Meaning, don’t remove people the fresh new money, try not to skip any expenses due dates, plus don’t fund some thing prior to all of the documents try finalized. Their loan’s recognition is, to some extent, oriented off the borrowing from the bank once your implement, so never exposure the loan are stopped otherwise denied more than financing something that you you will hold off 2-3 weeks to find.