So much believe and energy go into choosing and you may applying for home financing, it’s easy to ignore you to definitely closing with it is not necessarily the end of one’s line. As an alternative, simple fact is that start of a journey which could last ages.

Watch for alterations in whom covers your mortgage.

While the a citizen, your home loan try an individual responsibility. To have a financial institution, its a valuable asset – one that can be purchased and you may offered just like any other financing.

Immediately after closing, you may find your own financial is on time on the move. It is rather popular having lenders to market the liberties for your own prominent and you may desire payments. In that way, they found dollars they can used to originate even more mortgage loans having other borrowers to shop for a home. It indicates you’re making the month-to-month mortgage payments so you can yet another organization one to ordered your loan.

Their mortgage company can also offer the fresh upkeep of one’s mortgage. The brand new repair of your home mortgage entails responsibilities such as collecting your payments, managing your property taxation and insurance coverage costs and you may providing taxation models.

The optimum time to find out about a great lender’s aim which have their mortgage is actually before you even submit an application for they. Ask your financial that happen to be maintenance their home loan immediately after closure. Considering essential a mortgage will be to debt considered, you will need to certain it might be addressed effortlessly and you will that have receptive provider.

Carry out home financing document.

After closing, you can leave which have a collection of domestic important factors and an tremendous bunch away from data. Try to keep one or more content of any document closed throughout the closing. Observe that your action and home loan documents are usually registered in the a county courthouse, where it become public list.

Prepare yourself getting inundated with also provides.

You probably know how we just said your own deed and you will financial become public records? This is why you need to grit your teeth to own a flood from conversion pitches of all types on your own mailbox.

You are getting this type of solicitations as the deed and you may home loan was in fact submitted in public areas pointers that is employed by other providers into the purchases.

Some of those pitches might possibly be to have home guarantees. In case your vendor don’t offer one to, you really need to find out the positives and negatives away from home guarantees before you get you to.

you will end up being encouraged to get life insurance coverage. For many who may not be alone life style beneath your the fresh rooftop, it might seem sensible to look at life insurance policies, which means your survivors gets currency to pay off the mortgage and gives to other loans. It is vital to choose the type of life insurance policies cautiously to include your family.

Get rid of PMI if you can.

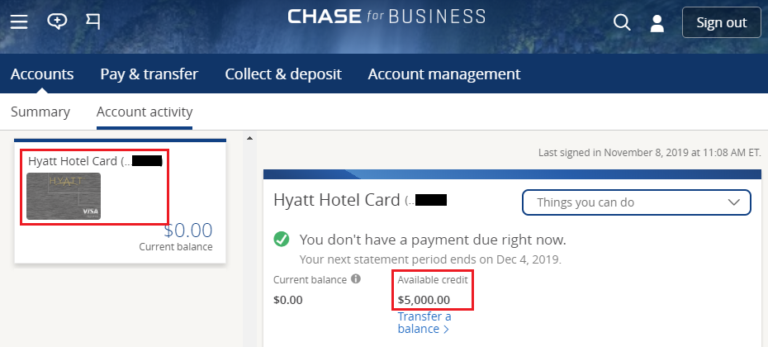

When you take towards a normal financial and come up with an all the way down percentage regarding lower than 20% of your purchase price, it is possible to are apt to have to fund private home loan insurance policies (PMI) per month. That it insurance coverage does not protect you but alternatively the lender out of your risk of defaulting on financing.

For most loans the new PMI at some point come-off, but in some cases can also be removed earlier at borrower’s request in the event the equity home are at a beneficial pre-calculated count. Look at the financing files or name their home loan servicer to understand the new terms of your loan.

Understand the escrow.

Whether your mortgage servicer is gathering your house taxation and you can people insurance costs in your payment per month, which cash is stored in what exactly is titled a keen escrow membership. The latest servicer usually remit payment from your own escrow account towards suitable organizations. Generally, those individuals costs are made a year. Recall your current mortgage payment you will vary having transform on your assets taxation and you may homeowners insurance superior due. The servicer will provide your a yearly escrow membership report and notify you throughout the alterations in your escrow for these numbers.

Loose time waiting for their financial income tax forms.

When submitting your government income tax return, you might be able to deduct the attention you paid back to the your own home loan regarding processing seasons. Your own home loan servicer account the level of attention playing with Internal revenue service Function 1098. Be sure to wait until you will get this form to file your own taxes, so you cannot lose out on a prospective deduction. Present taxation reform changes limit the attract deduction for mortgages, so make sure you check with your taxation advisor regarding your private situation.

Screen rates.

In the event the mortgage rates shed, it is possible to take advantage of refinancing. Which may be a less complicated disperse having a great Virtual assistant financing, instead of conventional loan, by the refinancing that have good Virtual assistant Interest Protection Refinance mortgage. An effective Va IRRRL provides a smooth procedure having refinancing with usually zero requirement for a house assessment much less papers.

The decision to refinance really should not be made gently. Refinancing could end right up costing you extra money across the a lot of time work with, particularly if you have been purchasing on the established home loan for several years. When considering your options, take into account the closing prices so you can re-finance, the prospective savings as well as how longer you intend to remain home.

USAA Household Learning Cardio will bring informative real estate information, devices and ideas to book your travel. Blogs could possibly get speak about issues americash loans Anniston, keeps otherwise characteristics one USAA cannot offer. I recommend no particular services.