- A trouble detachment (delivering money from your bank account)

- An excellent 401(k) financing (borrowing from the bank money from your bank account)

- One another a hardship withdrawal and you will a 401(k) loan (combining both possibilities)

Solution 1: Difficulty Withdrawal

Is to shop for property an excellent hardship? Fundamentally, the Internal revenue service allows they if the cash is urgently you’ll need for the newest advance payment toward a main household. This new Internal revenue service makes it possible for good $ten,one hundred thousand withdrawal for each individual of these more youthful than just 59? to eliminate the 10% penalty less than particular things (including first-go out domestic purchase). You’re going to have to shell out income tax into the number withdrawn; consider the Internal revenue service website to find out more .

Solution 2: 401(k) Financing

The guidelines to have loans is actually tight. The fresh borrower (you) normally obtain fifty percent of your vested 401(k) balance or a total of $50,000, almost any is lower.

- No very early detachment penalty

- No taxes toward count taken

- Zero credit assessment, that it cannot apply at your borrowing

The fresh repayment plan in addition to interest rate are often just like a mortgage. Generally speaking, teams have five years to repay the borrowed funds, however, more employers and you can bundle directors has different timelines.

Most arrangements costs mortgage comparable to the prime rates plus one percent. The attention is not paid off so you’re able to a loan provider (given that personnel try borrowing from the bank his or her own money.) The eye billed is actually put in your 401(k) membership.

Guidelines for almost all 401(k) loans essentially want a good five-season amortizing payment schedule. Yet not, you could potentially repay the mortgage quicker as opposed to a penalty.

Very preparations make it professionals to invest straight back the borrowed funds using payroll write-offs. However, such money is having immediately following-income tax dollars, perhaps not pre-taxation cash just as in the first investment towards the 401(k).

What if your remove your job? Therefore, the loan should be paid back by the next federal income tax get back or it might be believed a withdrawal. (Prior to 2018 income tax rules changes, professionals having the 401(k) financing and were laid off otherwise discharged just had 60 days to spend right back the latest loans.) Following, you may be taxed with the share at full rates, therefore the 10 percent punishment.

Be aware: of many arrangements wouldn’t let borrowers create the benefits till the loan was reduced. Thus, so it mortgage shall be pricey in terms of what you should never be protecting rather than receiving (the company fits for the efforts).

When your household get requires fund outside of the 401(k) financing options, you may want to think about the adversity detachment. Take note: certain workplace 401(k) agreements need you to very first take out financing before looking to the difficulty detachment.

Company Conditions and terms toward 401(k) Mortgages

Credit up against an effective 401k package try greeting by-law, however, that doesn’t mean your employer allows it. Of several small enterprises just can’t afford it. Having said that, money was an element of all of the 401k agreements. If the provided, an employer must comply with specific extremely rigid and detailed recommendations into the to make and you will providing her or him.

- If or not loans are permitted after all

- What amount of fund allowed

- If or not fund have to be to possess the absolute minimum amount

- The speed that borrowers need to pay

In the ninety percent out of 401(k) contributors get access to money, centered on browse conducted by the National Bureau regarding Monetary Lookup (NBER). NBER as well as unearthed that an average of the total amount borrowed that have an effective brand new mortgage is about $7,800, because the mediocre complete loan amount (around the most of the loans) is all about $10,one hundred thousand.

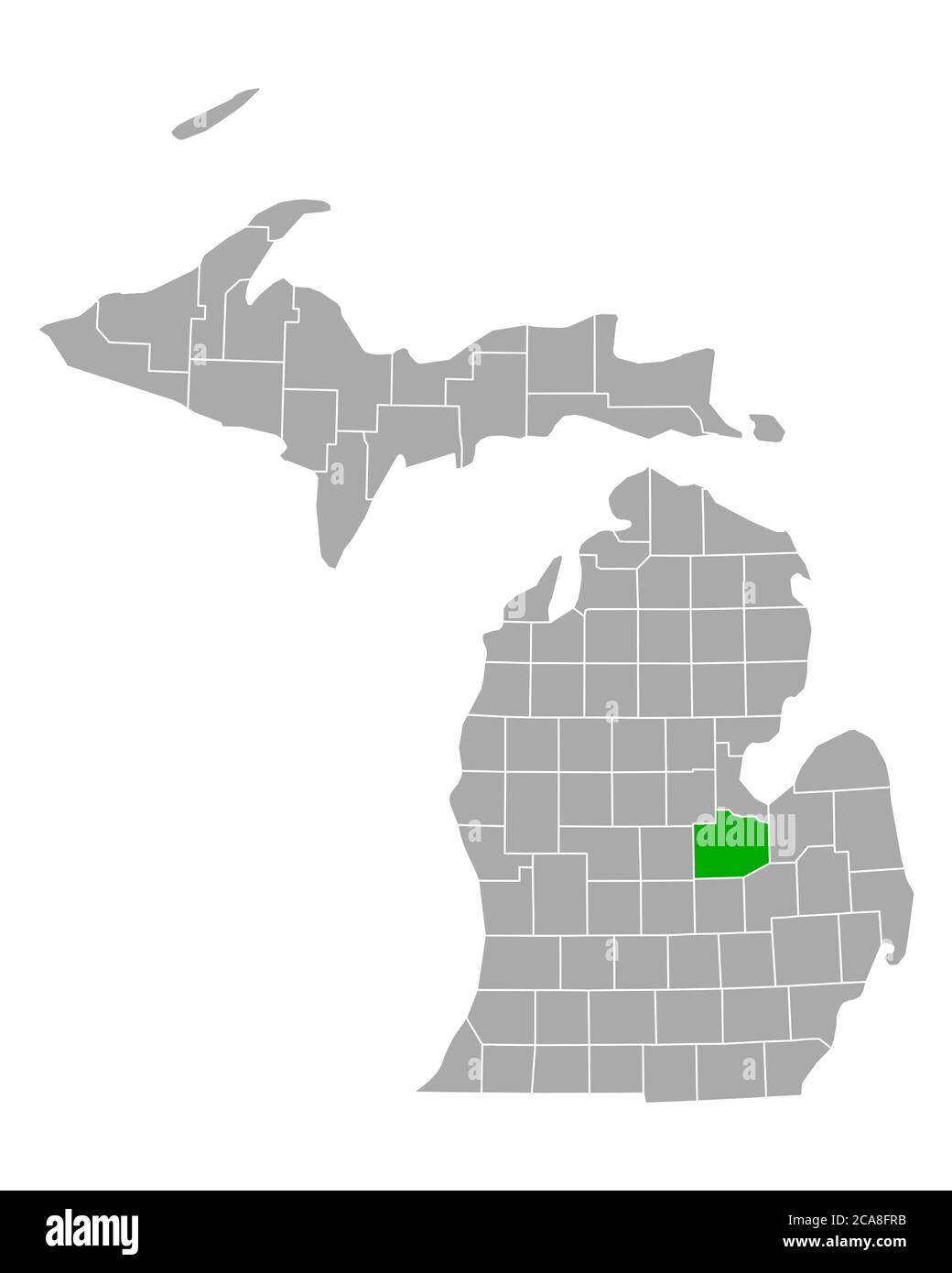

Regarding the forty percent out of agreements interviewed from the NBER ensure it is professionals so you’re able to take-out a couple of finance at the same time. Throughout five americash loans Gleneagle years, NBER discovered that nearly 40 per cent off bundle users took out funds from its 401(k).