Isn’t it time to look at good fixer-higher family? We are able to assist! Within PacRes, you can expect around three various other mortgage factors* for property that require reline or Restricted 203K, FHA Complete otherwise Practical 203K, and you will Federal national mortgage association HomeStyle Repair. Due to the fact each of these factors coverage different amounts of renovations, we’re going to go over much more information for every single you to yourself.

FHA Improve 203K Loan Alternative

The Improve or Restricted 203K financing was an enthusiastic FHA mortgage, for example its government-recognized and you may lets around $thirty five,100000 inside fixes and you can restoration.

Direct Color otherwise Shape Removal: Direct decorate and you will mold try significant issues for regular mortgage financial support. Such most often build both more mature property and belongings that happen to be sitting unoccupied for an excessive period. These are eligible version of remediation to own an effective 203K improve.

Small Renovations: The fresh new 203K improve financing allows for very particular build getting house interior spaces. Do you have possibly a home or restroom upgrade planned for the fixer-top? Nothing wrong! (Just be sure to prevent architectural repairs, as the those people commonly covered with a beneficial 203K improve.)

Flooring & Appliances: One another carpet and you can equipment, in addition to totally free-condition selections, washing machines, dryers, and you can fridges, are common eligible for a good 203K Improve.

Exterior, Screen, otherwise Doorway Replacement for: You can exchange possibly dated, broken, otherwise forgotten exterior, windows and doors using a great 203K Streamline financing.

Rooftop, Gutters, or Downspouts: Did your residence inspector state the latest roof would not history? An excellent 203K Improve is a fantastic substitute for both repair or replace these items.

Accessibility developments: You will possibly not think about this as the a beneficial fixer-higher state, in case anyone residing our home provides accessibility need, a beneficial 203K improve is a great treatment for improve house obtainable.

FHA Complete 203K** Loan Choice

The newest FHA Full or Standard 203K is actually a development of the Improve 203K financing. A full 203K enables more difficult renovations in your fixer-upper, and rehab works which is costly than the $thirty five,100000 limit of your own Improve financing.

An entire 203K loan requires the the means to access an effective HUD representative. The associate draws in the papers and you can works together both you and your contractors locate a write-upwards until the appraisal review. The Streamline 203K does not require a beneficial HUD representative, you could go for one to if you wish to. Here are some even more fixes and you may home improvements the Full 203K financing it allows.

Architectural Improvements otherwise Improvements: Do you wish to add an area to make more room obtainable? What about slamming away a lot-results wall structure? Have you been hoping for extending your kitchen away an additional four feet to make more room? A complete 203K allows structural enhancements or adjustments, as long he could be connected to the current framework.

Minor Basis Things: Really does your home possess minor foundation points? Such as, the newest sill dish is a shield between the base of your walls therefore the top of the base otherwise basements. Sporadically this new sill plate need replacement, hence demands jacking up the complete home to elevator it well the foundation. A full 203K loan allows which and other base treatments.

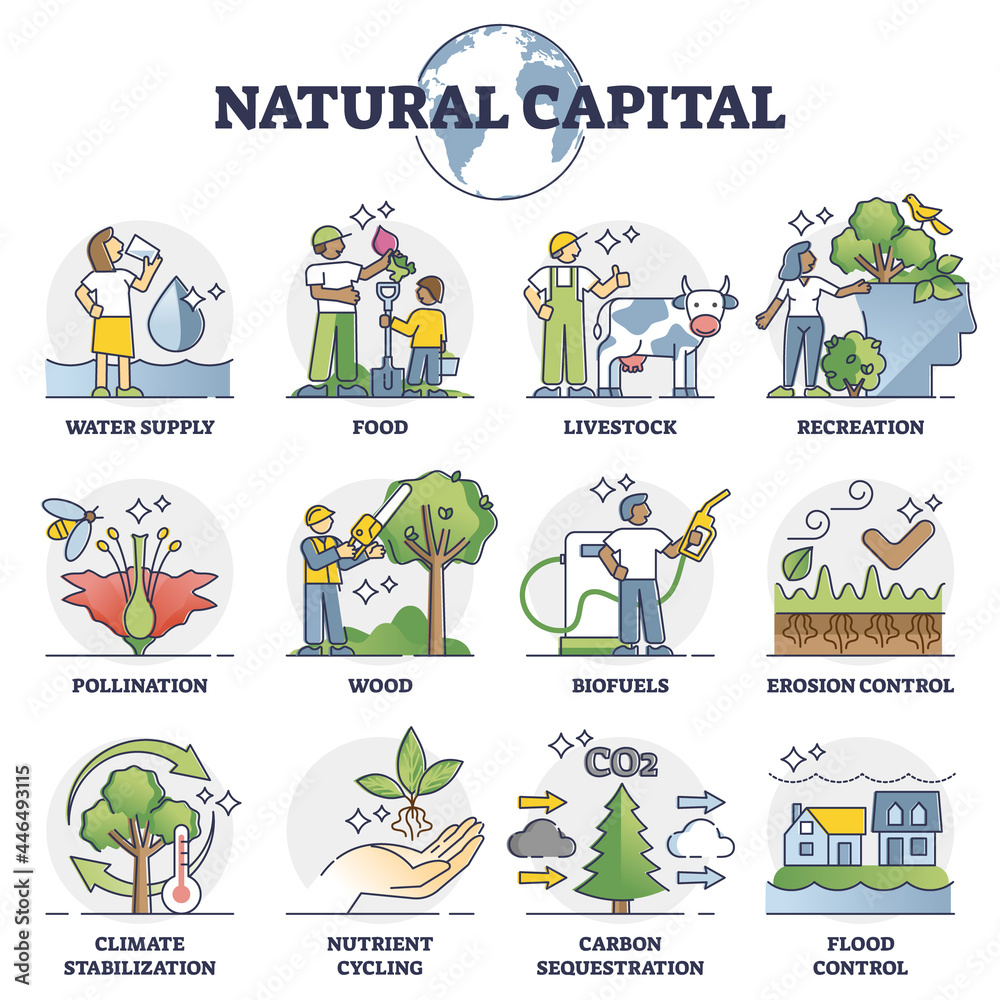

Major Land Work and Webpages Improve: When you are which have property erosion things and other big landscaping issues, an entire 203K mortgage is a great answer. So it mortgage allows really works one boosts the worth of the fresh assets otherwise do if you don’t have to preserve the property from erosion, including the modification away from leveling and drainage trouble.

Termite otherwise Insect Issues: There is nothing quite like understanding your own structure is unpredictable while the termites provides chewed because of him or her. A great 203K Full loan will assist you to boost structural ruin due to the fact a result of some bugs.

Fannie mae HomeStyle Renovation Financing Option

Will you be in a situation which have good fixer-upper assets, but you wouldn’t like an enthusiastic FHA loan, otherwise your house is perhaps not qualified to receive FHA? Fannie Mae’s HomeStyle Renovation mortgage might be a beneficial provider having you. HomeStyle is a conventional mortgage product which and additionally lets clients so you’re able to loans its treatment costs with the financing.

In the place of FHA funds, HomeStyle works well with funding properties and you can next homes. Deductible solutions are priced between easy remodels compliment of architectural improvements and you will updates, also, but not simply for, the next:

Create a storage, Pool Home, otherwise Totally free-Standing Connection House Product: In the place of new FHA treatment money, HomeStyle enables specific enhancements which are not affixed to your present build.

Generate Luxury Affairs: HomeStyle permits upgrades and you can the fresh new builds getting outside living area, instance created-from inside the outside kitchen areas, BBQs, fires, and you may swimming pools.

Last Work at a freshly Situated Family: You need HomeStyle to do the last work on an excellent family, so long as the house is at least 90% complete currently. Additionally, the remaining advancements need to be regarding low-structural products that the fresh creator was struggling to become. Particularly, you might complete flooring, best same day cash advance app shelves, kitchen appliances, fixtures, and you may trim, as well as others.

More Information

We like providing subscribers by any means we could! Check out these types of even more stuff to learn more from the home improvements and the financing options available.