Jackie Barikhan: Steve, I would personally point out that people i work at, possess credit scores in the higher 600 towards higher 700’s

Once inside a bluish moon, we will have an 800+ appear, however you be aware of the person with average skills is good where range. Credit ratings are a sign of what are you doing in your life. .. proper… very this is the industry we live in today, however understand… up until now, we are really not watching of many defaults but really, so which is a good…. not in the home loan place.

Steve O: Ok that’s advisable that you hear, Perhaps We care and attention much about this whenever i see what’s happening for the benefit. What you need to create is enter into a grocery store or a gas route otherwise any sort of, and then you learn there is this dilemma towards roof financial obligation. I am curious if you know on the ways your debt was right now, can it be one some other, nevertheless doesn’t really seem like it is…

Jackie Barikhan: Better I think many it should create which have where you are at in the united states also, I am talking about… within Orange County, Ca, in which I’m at the… they is like a small ripple here, you understand we are just like sun, happy days. Everything seems to be variety of typical to right here and folks will always be venturing out to eat, individuals are nevertheless going to the video, to shop for autos, taking vacations. There is certainly however enough organization that’s taking place… nevertheless know we zippped up so you’re able to Los angeles several weeks ago, therefore are another business upwards indeed there in a few portion, not really what I am used to seeing once i go to La, therefore was variety of unfortunate.

Steve O : Yeah You will find nearest and dearest within the Newport Seashore and i entirely agree, it is such as for instance it is said preciselywhat are your speaking of, we don’t have that right here. We shall see what happens on the loans threshold, we shall select fascinating moments ahead. Very regarding loan providers again, how do loan providers take a look at income and you can a position balance to have a financial statement mortgage, considering the fact that traditional money confirmation steps like a great W-2 may not be readily available?

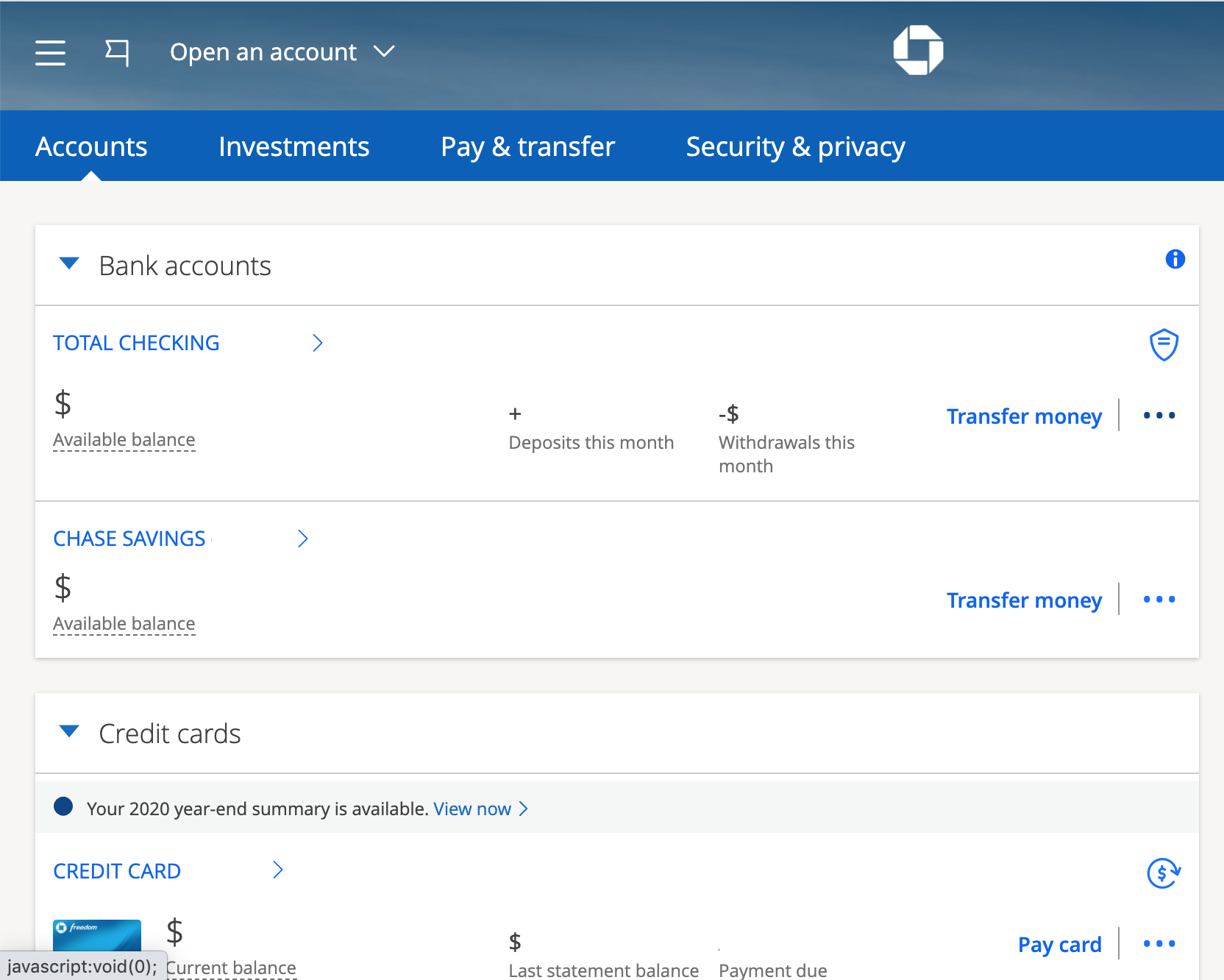

Jackie Barikhan : Well again the bank statement loans are looking at the income we can discover, using the bank statements as income, so tax returns are not required. No W-2s or K1’s either. Stability of the business is looked at, by length of time the business has been in business.

I shall give you an illustration, say by way of example.. we make use of your lender statements to prove your earnings. We could look at it one or two various methods: you can utilize one year off bank comments, which would be the latest 1 year, or we could request a deeper look back several months, which will be 24 months or couple of years. Possibly to your 24 month review months, you’ll get a bit ideal interest, as it reveals significantly more balance and this particular topic.

Let us explore what happened in the 2020 and you may 2021, there are enough small businesses one to suffered, so we wouldn’t probably want to look back for 24 months with that team.

I’m watching often a tad bit more loans folks are holding, that can lead to your own credit scores going down a small bit

An easier way to meet the requirements, is to glance at just the newest 12 months on their bank statements, so that as much time as we can see one business is straight back right up once again, everything is running along, and they’re earning profits again, following installment loans Iowa we would want to see one to, to show the true income that team will be generating to help you be able to pay financing back.