The lending company usually compare the newest related monthly mortgage amortization into month-to-month money (they usually keeps a minimum terrible month-to-month money needs)

If you are looking for yet another household, package, or condominium product, opting for home financing-generally named a housing financing-the most crucial economic choices you have got to build.

Regrettably, most people just go through the interest while looking for a casing loan. There was far more to help you they than the pace. Plus don’t believe in ads, which try not to inform you everything you. Here are the 10 main what you need to inquire of their financial otherwise home loan company:

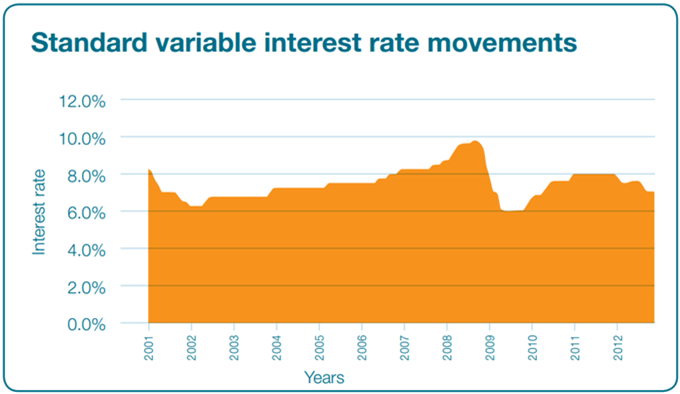

step one. How do you determine their interest? Do not just ask for the rate. Certain banks bring a very low teaser rates toward first 12 months, then jack it up the coming year. Really provide changeable-rate finance, also known as changeable-price mortgages. They adjust annually or try repaired for a lot of age, regarding a couple of so you’re able to 10, and then changes afterwards. It is merely recently one to a number of loan providers already been providing fixed-rate mortgages one lock the pace for twenty five years, the complete time of the loan.

For adjustable-rate money, you will simply understand the very first rate when you pertain. Then, the fresh prevailing speed commonly incorporate. But that doesn’t reveal something. That’s why you have to ask the bank exercise this new rate of interest inside the succeeding age. After the repaired period, banking companies will ask you for a speeds centered on a formula, which is a collection plus a certain pass on. The index is often the 364-day T-statement speed. The newest give otherwise margin is when much the lending company often earn to cover its expenses and also make money. 2. How often do you to alter the rate or over to help you how much? To have changeable-price funds, after any repaired months, pricing was adjusted or repriced yearly. However you need ask if they in addition to reprice all the quarter, if you should go for which. Ask in addition to if you can option ranging from yearly otherwise every quarter. Including, you need to query if the lender also offers a performance cover or rate defense to own annual repricing, which is the ceiling otherwise restriction rate they’re going to costs all of the seasons while in the a specific months, state for 5 ages. There may even be the ground or minimum rate for their very own defense, therefore financial institutions would not beat in case costs slide greatly.

step three. How can you compute the most loan amount? Banks have a tendency to lend you a maximum amount according to research by the appraised or market value of the house we should pick or security you will be giving. Don’t be timid to inquire about exactly how liberal he could be within the appraising your property. Some banking companies be much more conventional within their prices-regarding setup characteristics, function the significance below the genuine price point-and others be much more good-sized, particularly if coursed because of property developers.

The maximum you’ll technically get is actually computed while the a share of your own appraised value. To own plenty and you can condominiums, it’s generally 60%. For family and you may loads, it’s 70%. Particular finance companies give doing 80% depending on the property’s place and you will designer. Alex Ilagan, older vice president off East Western Lender, claims, The higher the loan so you can collateral really worth proportion, the higher it could be on debtor whilst often wanted him to spend a lower life expectancy equity. The flip side compared to that ‘s the needed deposit otherwise equity you have to coughing right up.

Therefore even though your property have a top appraisal well worth but your income is not as large, banks only will promote in order to lend a smaller amount than what your removed, lengthen the original identity, otherwise suggest almost every other tips to make sure you normally finest pay for the mortgage

4. What will I really rating? Remember regardless if that you will not instantly have the limit amount borrowed due to the fact bank often assess your allowance considering your income Bellamy loans. Inquire just what borrowing proportion is actually, the new restrict it does in fact lend your. Banking institutions constantly set the borrowing from the bank ratio to as much as 30% of your gross monthly domestic money. The fresh worst-case scenario, naturally, will be your app might be disapproved.